Why You Should Invest Your Matched Betting Income

/Matched betting can be a lucrative income source. What is it? In one sentence, matched betting is the process of placing opposing bets to extract monetary value from bookmaker offers.

The pre-informed, who are clued in to the world of matched betting, will have read that sentence and moved on. Others will have no idea what I’m talking about. If you’re the former, this article is designed for you, if you’re the latter, take a look at my matched betting FAQ guide first.

The Biggest Advantage Of Matched Betting Income

Matched betting income has a whole host of advantages to it. You can earn money from anywhere. All you need is a device with an internet connection. You don’t need a lot of capital to get started (around £50 is enough).

But the biggest advantage, in my opinion, is that matched betting income is tax free. Why is it tax free? Because the income you earn is classed as betting income, which is tax free in the UK.

And this has been the case in the UK since the abolishment of betting duty in 2001.

What Do You Do With Your Matched Betting Income?

Before reading any further, answer this question. Where does your tax free matched betting income currently go? A holiday fund? A house deposit? Your current account - where it goes towards your general spending?

Wherever it goes now, I’m going to attempt to make the case for taking your matched betting income and investing it.

But first, you’ll need to know how much you’re actually making from matched betting. If you already have a way of tracking your matched betting income, great. But if you don’t, I’d suggest tracking it via spreadsheet.

You can make your own or get the one I use here.

Investing Your Regular Earned Income

Once you know much much you’re earning, the next step is to show you why investing your matched betting income can be lucrative. So what normally happens when you decide to invest your income?

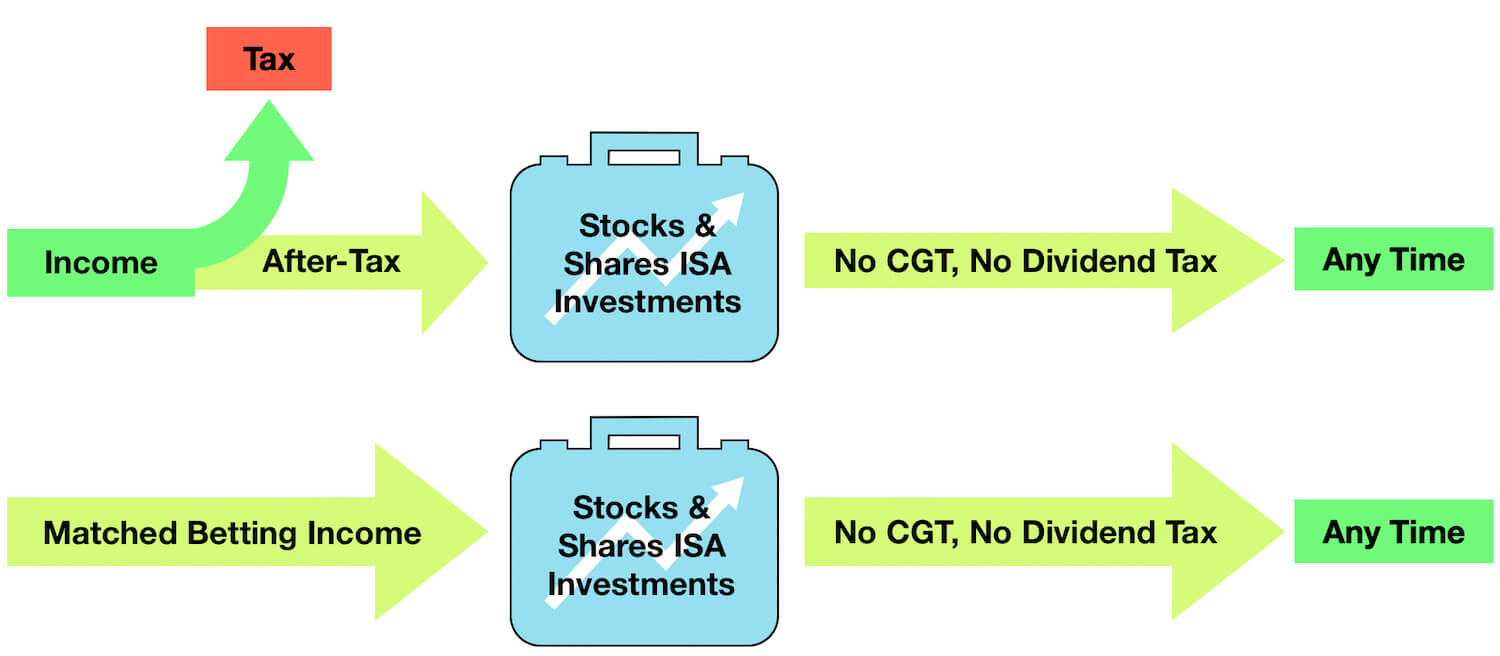

If you want to minimise the tax you pay on your investments, you usually go down one of two routes. One method is to invest your after-tax earnings through an ISA. The second is to invest your pre-tax earnings through a retirement account, like a workplace pension or a SIPP (Self Invested Personal Pension).

In the case of investing through an ISA, you’re paying tax on your income and then you’re investing your post-tax earnings. Any capital gains or income you make in your ISA are tax free, but don’t forget, you’ve already been taxed in the first place.

In the case of pension investing, most people won’t pay tax on their contributions but they will pay tax on the income they eventually take from their pension pot.

In either scenario, you’re paying tax somewhere along the line.

Investing Matched Betting Income

If done right, by investing your matched betting income, you can remove tax from the equation entirely (you can even get into negative taxation territory - more on that later). Since taxes can be one of the biggest investing expenses, this gives you a big advantage over other investors. So, how do you do it?

Simple. You take your tax free matched betting income and you invest it through a tax efficient ISA. This way, you’re not paying tax on your initial investment (since your matched betting income is tax free), you’re not paying investment income taxes (eg. dividend tax) and you’re not paying Capital Gains Tax (CGT) if you sell (since the investments are held within an ISA).

You earn it tax free, you invest it tax free, you earn from it tax free and you sell it tax free.

ISAs come in a few different forms and I’m going to focus on two here. In any case, during a tax year you can contribute anything up to the ISA limit (£20,000 in 2019/20) and you can put money into one of each ISA type.

Putting Matched Betting Income Into Stocks and Shares ISA

The Stocks and Shares ISA (S&S ISA) is your standard tax-free investment account. No capital gains tax on profits when you sell and no tax on income like dividends. If you invest your tax free matched betting income through a S&S ISA, you won’t get hit with tax on the way in or the way out. Plus, you can withdraw from your S&S ISA at any time. That gives you a great investment advantage.

Putting Matched Betting Income Into A Lifetime ISA

Here’s where it gets interesting. The Lifetime ISA doesn’t just allow you to grow your investments, earn from them and sell them tax free. You’ll actually be given a government bonus too. The government will give you a 25% bonus on any annual contributions up to £4000.

The catch? There are a few. You must open the account before you turn 40 and you can only contribute between ages 18 and 50. Plus, you can only withdraw penalty free if you do so when you go to purchase your first home, or you turn 60. For all the details, check out the government’s website.

So what does this mean if you plan on investing your matched betting income over the long term?

You won’t pay tax on your matched betting income, the government will give you a bonus worth up to £1000 per year on top of that, you won’t pay CGT if you make a gains and you won’t pay tax on any investment income.

Talk about tax efficiency!

What Should You Invest In?

Solving the tax problem is one thing. Solving the asset allocation problem is, of course, another. If you’re going to invest in an overtly risky single stock or a mutual fund that overcharges on an ongoing basis, the tax benefit is quickly cancelled out.

And there are a whole host of investment types to choose from. Individual stocks, bonds, mutual funds, index funds.

I’ve previously gone into detail on these investment options, looking at the pros and cons of each. But, if you’re a regular reader of this blog, you’ll know that I am a big proponent of long term index investing. The simple, diversified, low cost, tax-efficient investment strategy espoused by the late John Bogle.

So how does it work? In a nutshell, instead of owning a mutual fund that attempts to beat the market (and charges you relatively high fees to do so), you just own the market. You buy into a fund that tracks an index, like the FTSE All-Share or the S&P 500.

S&P 500 Index Best and Worst Periods

The first index fund, brought into existence in July 1971, tracked the S&P 500 (the American ‘Fortune 500’). And since 1928, here’s how the index has performed, adjusting for inflation.

In any 20 year period between 1928 and 2017, including the best (1980-1999) and the worst (1929-1948), the index delivered positive inflation-adjusted returns. There were no 20 year periods that delivered a loss, and that’s taking into account inflation.

In any 30 year period, returns ranged from 4.3% (1965-1994) to 10.1% (1932-1961).

In any 40 year period, returns ranged from 4.2% (1969-2008) to 8.8% (1933-1972).

Taking into account the average returns over those periods, most long term investors would have seen positive returns ranging between 6% and 8%, inflation-adjusted.

My portfolio is comprised of a globally diversified index fund through Vanguard. It’s held in a Stocks and Shares ISA and all dividends are automatically reinvested back into the fund. I’ve been publishing monthly investment reports dating back to June 2018 if you want to take a look at my investments in greater detail.

Whatever strategy you choose, this is about taking full advantage of the matched betting/ISA combo to maximise your investment returns.

Matched Betting Might Not Be Lucrative Forever

There’s no doubt about it. The matched betting industry has been booming in recent years. Matched betting software sites, like Outplayed (formerly Profit Accumulator), now have hundreds of thousands of customers, who earn thousands of pounds each and every month.

We are clearly in a golden age of easy, tax free income.

But bookmakers don’t like losing money, governments can change tax policy and, on a more individual level, bookmaker accounts can be ‘gubbed’. The matched betting term for when a bookie no longer gives you access to offers (likely because they think you’re a matched bettor).

My advice? Make the most of the well whilst you can still harvest the water.

Conclusion

Matched betting might be temporary but long term, low cost, diversified index investing isn’t. And it allows you to turn your primary, fleeting tax free income source into a secondary long term tax-free income source. One that can grow, earn on its own and compound over time.

I would love to hear what you guys do with your matched betting income? Are you saving it, spending it or investing it? What do you think about the idea of investing your matched betting income to be ultra-tax-efficient and help grow your wealth over time? Let me know in the comments section down below.

Recommended Resources

Whether you’re interested in matched betting, investing or both, here are my top recommended resources:

OutPlayed - My recommended matched betting software

Get 1 Free Share With FreeTrade - Sign up for free to the FreeTrade investing app and get 1 free share (up to £200 value) with my referral bonus.

Facebook - UK Passive Investing Group - Join a like-minded community of investors, content creators and industry experts.

Check out my offers page to earn some free money and grab some freebies.

Rich Dad, Poor Dad by Robert Kiyosaki

The Little Book of Common Sense Investing by John C Bogle

The Intelligent Investor by Benjamin Graham

The best UK free share referral offers, updated throughout January 2026. Get free stocks and shares with Shares App, FreeTrade, Stake and more.