How To Start Investing Young

/One of the biggest indicators of your income bracket is, quite simply, your age. Up until retirement age your income is likely to increase. Income is also usually seen as the best way to increase your wealth. So the older you are, the more income you are likely to earn, the easier it will be to build your wealth. Correct? Not necessarily.

Let’s imagine you are 25 years old and you are earning a pretty average £25,000 per year here in the UK. The number doesn’t really matter. Let’s also imagine you are a complete investing beginner. Here is my story combined with a full comprehensive guide on how to start investing young.

Contents

- How I Think About Money

- Compounding Returns

- - Start Now

- - How Much Do You Need To Get Started?

- Tax Wrappers

- - Stocks and Shares ISA

- - Self Invested Personal Pension

- - Lifetime ISA

- Boost Your Returns

- - Passive Investing

- - Dividend Reinvestment

- - Keep Taxes Low

- - Limit Your Spending: Opportunity Cost

- Start Investing

How I Think About Money

When I was younger and discovered bank interest, it was a mental game changer. This was effectively income produced by money that was already accrued. So it wasn’t that saving would allow me to buy an item or experience, it was that saving meant income, every year, continuously. This completely switched my savings mentality. I would be disappointed if my money wasn’t sitting in the best place to earn interest.

I would keep up to date with new accounts and if something better showed up, I would switch. I would even switch if the rate change was tiny. Why would I want to save in an account earning 1.75% interest when I could earn 1.78% interest somewhere else? I didn’t take the time or effort of switching into account. Mostly because I enjoyed it.

Although this started with bank accounts it inevitably led to investments. I was originally a hesitant investor because I had this mental image of a day trader in my head. I imagined buying low and selling high in one day, potentially earning a lot and potentially losing everything. Watching countless hours of Warren Buffett, Jack Bogle and others on YouTube altered that image.

At the time (and still to this day) interest rates were at historic lows. Money sitting in the bank was not just earning poor interest. It was earning such poor interest that it’s value could barely outpace inflation. In all my hours of research I came to the conclusion that index funds were the best option. More on that later. First.

Compounding Returns

Start Now, Not Next Year!

First of all, let’s talk about the major benefit of investing in the stock market. Compounding returns.

Small differences in return can significantly add up over time.

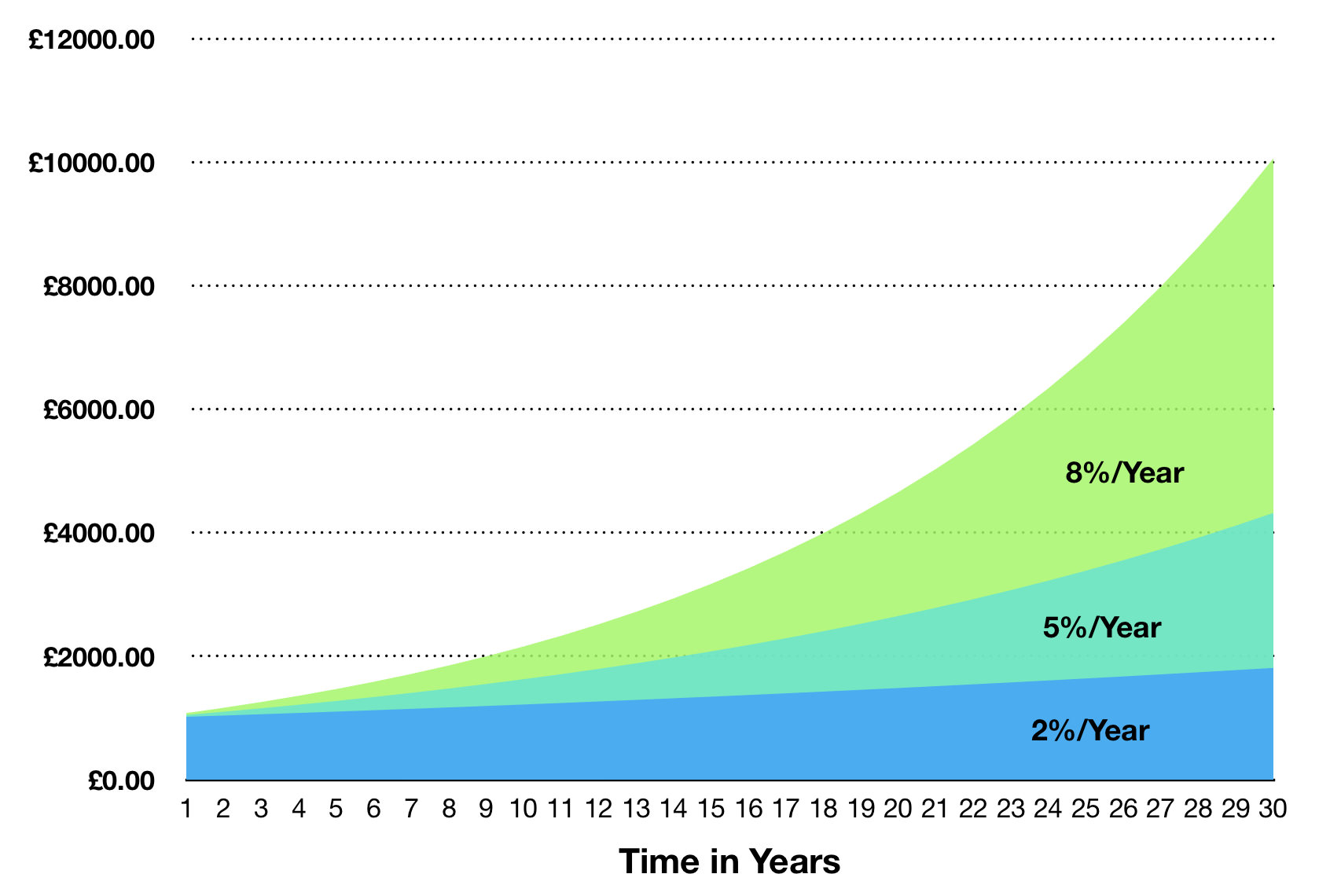

Let’s say you have managed to save up £1000 to start investing at 25 years old. Let’s see what happens, over a period of 20 years, with different rates of return (low, average and high).

At a rate of return of 2% per year, your £1000 would now be worth around £1485. At a more average rate of return, say 5%, the investment would be worth £2653. And at 8%, it would be worth £4660.

Now let’s say you waited just one year and invested that same £1000 at 26 years old. What would that be worth at 45 and how would that one year delay affect your return. At 2% annual growth, your investment would be worth £1456, 5% growth would equal £2526 and 8% growth would equal £4315.

In this example, the difference between investing £1000 at 25 vs 26 would be worth anything between £30 and £350 based on different annual rates of return.

This is the beauty of compound interest. The earlier you start, the more time is on your side. The more time is on your side, the less you have to initially invest.

If you start investing really early, a little sum of money can add up to a huge pot. Try out my return on investment calculator here and plug some numbers in. The results of compound interest might astonish you.

In the graph below, I have illustrated what a £1000 investment could be worth over 30 years based on different growth rates.

How Much Do You Need To Get Started Investing?

One of the most common questions I get asked is ‘how much money do you need to start investing?’. And the truth is very simple. You don’t need to have much money at all to get started investing. As you’ve seen above, even a small amount now can add up, through the magic of compound interest, over time.

I am not endorsed by Vanguard, an index fund provider here in the UK. But to give you an example, if you open a Vanguard UK account, as I did, you can invest from as little as £100 per month and/or £500 lump sum.

Tax Wrappers

So you’ve decided you want to start investing. Great. Now how do you go about actually investing in the stock market? First, choose a tax-wrapper for your investments.

A Stocks And Shares ISA

A stocks and shares ISA is effectively a tax-efficient wrapper around your investments. Your investments inside that wrapper can be altered as necessary. Every tax year (April to April), you have an ISA allowance. Currently, the 2021/22 ISA allowance is £20,000 and you are only allowed to open or contribute to one stocks and shares ISA per tax year.

You can contribute any amount up to the allowance limit and you can transfer your investments into an ISA using the Bed & ISA method.

S&S ISA Advantages:

No Capital Gains Tax (CGT) or tax on income/dividends from your investments held in the ISA wrapper.

Easy tax efficiency. You can contribute anything up to your annual allowance and don't have to worry about the tax implications if it grows to a substantial amount.

S&S ISA Disadvantages:

Anything contributed will be after-tax income. So you don't get any tax relief on the way in, just on the way out.

Liable for inheritance tax.

S&S ISA: Best Pick

Since my focus has been on low cost passive investing, I would recommend the Vanguard Stocks and Shares ISA. My article on the easiest form of passive income goes into more detail on why I chose this platform.

What Is A SIPP?

The Self-Invested Personal Pension (SIPP) is another tax efficient wrapper that grants you some tax relief on the way in (when you deposit), and some on the way out (income/withdrawal). Like an ISA you have control over your investments in a SIPP.

You can qualify for up to 45% tax relief on the money you contribute and the annual limit for this tax relief is currently £40,000. You can access your pension pot from age 55 and there are a number of options you have when it comes to receiving income.

SIPP Advantages:

Tax relief on the way in means your contributions are boosted. This means you have more money to invest which could potentially lead to greater returns than an ISA.

You can take up to 25% as a tax free lump sum after age 55. You then choose how your want to take your income on the other 75% (eg. cash, an annuity, flexi-access drawdown).

Inheritance tax planning. Your contributions can increase your tax efficiency by reducing the value of your estate that you pass on to beneficiaries after death.

SIPP Disadvantages:

You cannot usually access your pension pot until you turn 55.

You pay tax on most of the income from your pension.

The lifetime allowance. If your pension pot is worth more than £1.073,100 million (20/21), you are subject to further tax on the savings above this limit. This depends on how you are paid. The rate is 55% if you take a lump sum payment and 25% if you take it a different way (eg. pension payment).

What Is A Lifetime ISA?

A lifetime ISA (LISA) is specifically designed to help you save/invest for your first home or for when you turn 60. Since this article is related to long term investing, I will be focusing on the retirement advantages.

You can contribute up to £4000 each tax year (April to April) from ages 18 to 50. The LISA must be opened before age 40. The government will add a 25% bonus on top of your annual contributions (therefore up to £1000 each tax year). This £4000 counts towards your annual ISA limit (£20,000 in 20/21). You can withdraw income/investments from your LISA when you turn 60.

Lifetime ISA Advantages:

Annual 25% bonus can boost your returns over the long term.

No income tax or Capital Gains Tax (CGT) to pay

Lifetime ISA Disadvantages:

Liable for inheritance tax (unlike SIPPs)

Cannot access until age 60.

How To Boost Your Returns

Low Cost Passive Investing

If you don't have time or you are simply not interested in researching individual stocks (see the danger with single stocks) look into passive investment. Passive/index investing is a good way to invest properly in the stock market.

A passive investor is one that invests and forgets.

The pinnacle of passive investment is the index fund, which tracks the performance of the stock market. When you invest in an index fund, you basically own all of the companies that make up a given index (eg. FTSE 100 index or the S&P 500 index) in the correct proportion.

A FTSE 100 index fund for example, owns all of the shares included in the FTSE 100 index in the correct proportion. If company A makes up 1.5% of the index, 1.5% of your fund portfolio should be made up of company A. So when you see the index goes up or down, your investments match, or at least follow very closely, with that movement.

This is not the same as investing in a mutual fund. A mutual fund is run by a fund manager who picks stocks for you.

The ongoing costs associated with mutual funds (usually 1-2% per year) are substantially greater than index funds because it takes time/money/employees etc. to research/buy/sell stocks. In contrast, some index funds charge as little as 0.06% per year.

Also, if you see articles on index funds and index exchange traded funds (ETFs), just be aware they are not exactly the same. I compared the two in another article.

Dividend Reinvestment

When you receive income from an investment, this is known as a dividend. You have the option of either taking it as income or reinvesting it. Here is where you run into the terms 'Price Return' and 'Total Return'. 'Price Return' refers to the return on an investment where dividends are ignored.

In other words, the increase in the share price alone, a.k.a. the capital gain. 'Total Return' refers to the return you receive when dividends are reinvested over time.

The graph below shows the 'Price' and 'Total Return' of the S&P 500 Index from June 1988 to August 2017. The S&P 500 index tracks the top 500 companies listed on the New York Stock Exchange (NYSE) by market cap, the market value of individual companies (share price x number of outstanding shares).

This is a good illustration of how dividend reinvestment can dramatically increase the value of your portfolio over time.

Keep Taxes Low

An important aspect of investing long term is tax efficiency. You do not want to be paying tax unnecessarily on your investments. Luckily, the tax efficient wrappers outlined above, like a stocks and shares ISA, SIPP and Lifetime ISA are all great ways of reducing your tax liability.

Limit Your Spending: Opportunity Cost

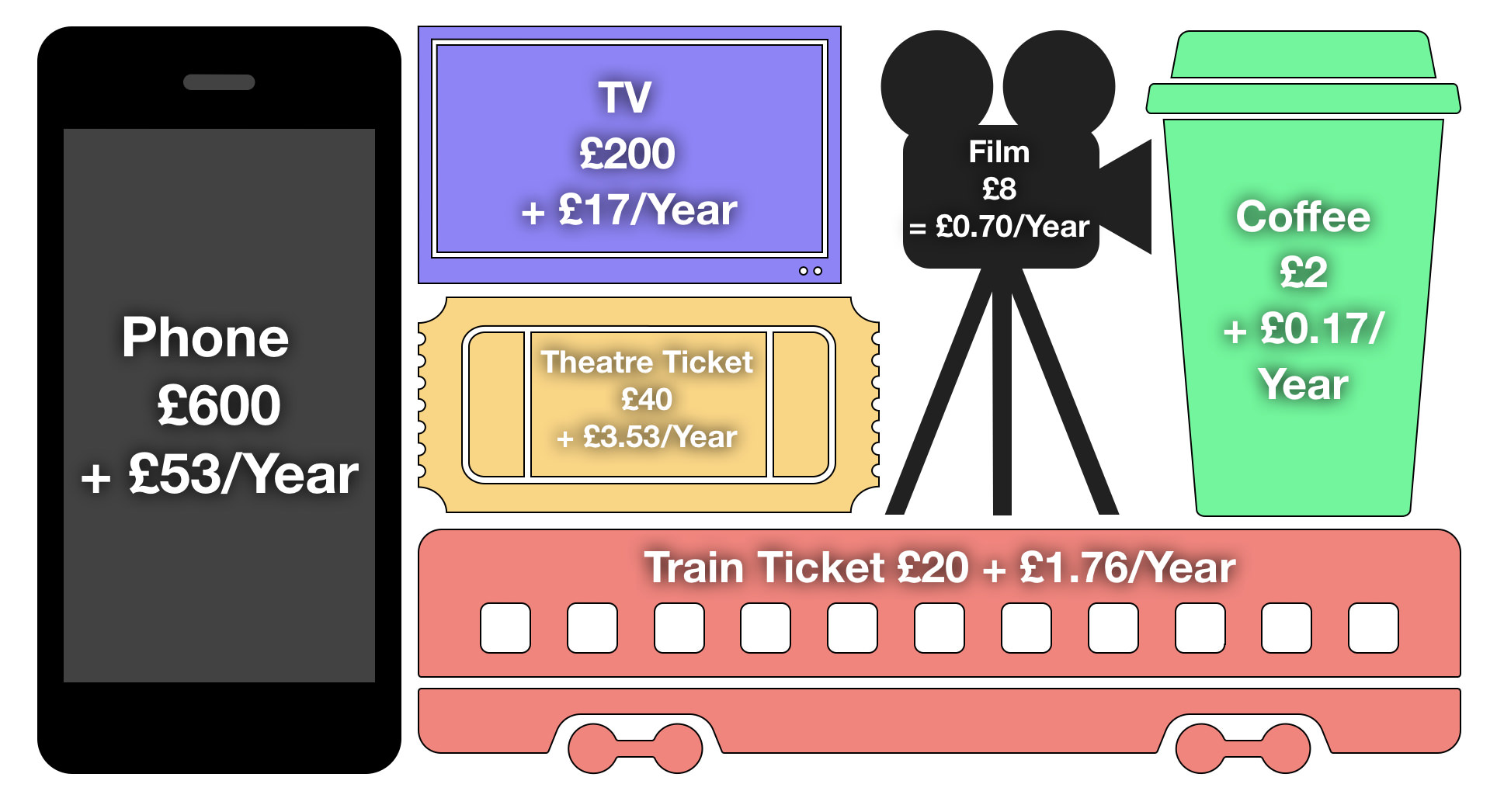

Don’t just concentrate on saving, reign in wasteful spending and keep more of this self-replicating asset: money. Think about it this way. When a purchase doesn’t produce income and/or doesn’t increase/appreciate in value, what does it really cost? It isn’t just the up front value. It is that plus any potential income which could be generated from that spent capital.

Below, I have taken the average cost of certain goods and services and then I have worked out how much income you would lose from making the purchase. I’ve based the return rate of 8.84% on the historical returns of a mixed index fund portfolio which includes a Global, US, UK and Emerging Markets stock index fund.

Phone = £600 or £53/year in lost income

TV = £200 or £17/year in lost income

Theatre Ticket = £40 or £3.53/year in lost income

Train Ticket = £20 or £1.76/year in lost income

Film = £8 or £0.70/year in lost income

Coffee = £2 or £0.17/year in lost income

Start Investing As Soon As Possible

There are advantages and disadvantages to using all of the methods outlined above. You can decide on one or take advantage of the options you have and use all of them. You don't have to put all of your eggs in one basket when it comes to long term investing.

The older you are, the more likely you are to be earning more money. But the younger you are, the more time you have for your money to grow.

So if you’re earning less now than you expect to be earning in 5 years, remember this. A little bit now can be worth more than a little bit more in 5 years. I am all for greater transparency in the world of personal finance. That’s why you can view my own portfolio of savings and investments here. It’s also there where you can find my monthly investment reports.

Also, I am aware that the world of personal finance, investing in particular, can be daunting to a beginner. I am, of course, happy to answer any questions down in the comments. I respond to each and every one.

If you want to get a better grip on financial education in the meantime, here are some of my recommendations:

Get 1 Free Share With FreeTrade - Sign up for a free FreeTrade account on the app and get 1 free share (up to £200 value) when you deposit £1 with my referral bonus. You can withdraw your deposit and sell the share if you wish.

Get 1 Free Share With Trading 212 - Sign up for free Trading 212 account on the app and get 1 free share (up to £100 value) when you deposit £1 with my referral bonus. You can withdraw your deposit and sell the share if you wish.

Savings/Investment Spreadsheet Downloadable - 30% of profits go to your charity of choice.

Facebook - UK Passive Investing Group - Join A Like-Minded Community

Check out my offers page to earn some free money and grab some freebies.

Rich Dad, Poor Dad by Robert Kiyosaki

The Little Book of Common Sense Investing by John C Bogle

The Intelligent Investor by Benjamin Graham

The best UK free share referral offers, updated throughout April 2024. Get free stocks and shares with Shares App, FreeTrade, Stake and more.