Amex UK Bonus and Referral Cuts - A Guide To Each Card

/I’ve been using an American Express Credit Card for a few years now. Overall, I love their product. But one of the big Amex incentives was their sign-up bonus. Towards the start of 2019, American Express UK have made big cuts to both their sign-up and referral bonuses, making the products on offer less attractive.

So, looking at each card, what changed?

The Platinum Card

Sign-Up Bonus:

No change - 30,000 MR Points when spend £2000 in 1st 3 months

Refer-a-Friend Bonus:

Was 18,000 MR Points (90,000 Annual Cap)

Now 12,000 MR Points (90,000 Annual Cap)

Amex Preferred Rewards Gold

Sign-Up Bonus:

Was 20,000 MR Points when spend £2000 in 1st 3 months (22,000 if referred)

Now 10,000 MR Points when spend £3000 in 1st 3 months (12,000 if referred)

Refer-a-Friend Bonus:

Was 9,000 MR Points (90,000 Annual Cap)

Now 6,000 MR Points (90,000 Annual Cap)

Amex Rewards Credit Card

Sign-Up Bonus:

Was 10,000 MR Points when spend £1000 in 1st 3 months

Now 5,000 MR Points when spend £2000 in 1st 3 months

No Refer-a-Friend Bonus: No change

Amex Rewards Low Rate Credit Card

Sign-Up Bonus:

Was 5,000 MR Points when spend £500 in 1st 3 months

Now 2,500 MR Points when spend £1000 in 1st 3 months

No Refer-a-Friend Bonus: No change

Other Amex Cards

As it stands, there have been no changes to the British Airways Amex cards (the standard BA Amex or premium), the Nectar Amex Card or the SPG Amex Card.

Are Amex Cards Still Worth it?

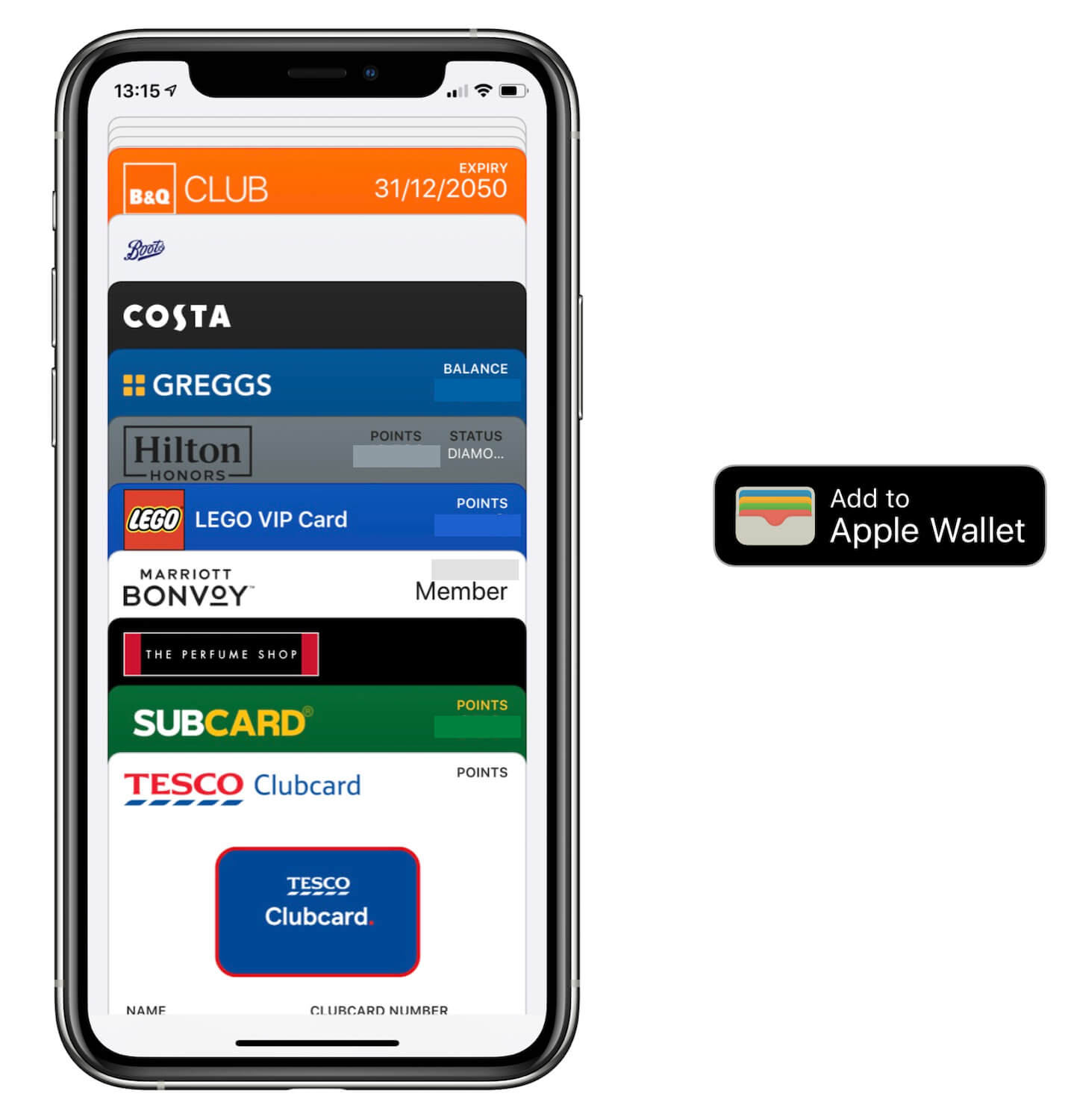

In my opinion, yes. Amex MR points, especially, are valuable and transferrable to a number of different products/point schemes. Redeeming MR for British Airways Avios is particularly valuable, when done correctly.

The American Express/Amazon offer alone (which is not guaranteed to last and changes month-to-month) is a great way of saving money on your online shopping.

That said, Amex is still a growing brand here in the UK. In comparison to the US especially, Amex products and bonuses are nowhere near as enticing. I personally think that reducing sign-up and referral incentives is a step in the wrong direction.

Remember: Always pay off your credit card, in full, every month.

APR Info:

American Express Preferred Rewards Gold: Representative 57.6% APR variable

British Airways American Express Premium Plus Card: Representative 76.0% APR variable

British Airways American Express: Representative 22.9% APR variable

Nectar Credit Card: Representative 28.2% APR variable

The Starwood Preferred Guest Credit Card: Representative 39.7% APR Variable

Rewards Low Rate Credit Card: Representative 9.9% APR Variable

Rewards Credit Card: Representative 22.9% APR Variable

Starbucks UK have updated Starbucks Rewards. Here’s how it works, with all your questions answered.