My Passive Investments - August 2020 (+3.97%)

/August continued to see significant growth in my Bricklink LEGO sales (eStore: Capital Creations). I’ve put a lot of focus into my Bricklink business this month, buying more sets and minifigures to sell. I even set up a new Instagram account. Due to Covid, I’m still only shipping domestically but I’ve been more than happy with Bricklink sales despite that.

I’ve been more active on Capital Matters lately and ad revenue/affiliate sales have been increasing as things return to some normalcy in the economic world. I do have a feeling, however, that Our Departure Board, our travel blog, will be lacking content for some time. Although we have some domestic travel planned, international travel is not on the cards any time soon (that hasn’t stopped us from trip planning though - Disney World/Disneyland California 2021?).

As we get closer to Q4 2020, both LEGO and Clan Candle sales should see continued growth so I’m looking forward to that as well.

As for the investments, here’s what happened in August 2020.

Remember, my investment decisions are exactly that, my own. As as UK-based investor, I based each investment decision on my own research. These are, by no means, investment recommendations. Before making any investment decision, you must do your own research and/or speak to a professional.

A Reminder of Why I Do These Reports In The First Place

You can read more about this in my first passive investor report, which I made all the way back in June 2018.

My Passive Investment Strategy

Long term, my aim is to invest a portion of my savings every month. An important note here is that the numbers in this report reflect the percentage gains and losses of the underlying investments. So when I deposit more to invest, for example, I would not state this as a gain in the value of my portfolio.

Similarly, if I sell a portion of my investments, this would not be stated as a loss in the value of my portfolio. The numbers simply reflect the performance of the underlying investments.

Previously, I invested around the 22nd of every month. For simplification purposes, I’m now investing at the start of the month. That way I can do my end of month finances (using this Savings and Investments tracker spreadsheet) on the last day of the month - as I have done for years - and then use those calculations to determine how much I’m investing at the start of the following month.

Vanguard Stocks and Shares ISA

All investments are held in a stocks and shares ISA with Vanguard. You can contribute anything up to the limit of £20,000 in the 2020/21 tax year. When it comes to investment income/selling any portion of my investments, thanks to the ISA wrapper, any dividend income/capital gain is tax free.

August Returns (+3.97%)

My Vanguard investments (100% Vanguard FTSE Global All Cap Index Fund) increased by +3.97% in the month of August.

The FTSE Global All Cap invests in over 6,600 stocks in small, medium and large companies, in a range of sectors across the globe. The fund is ‘accumulating’ so all dividends are automatically reinvested into the fund.

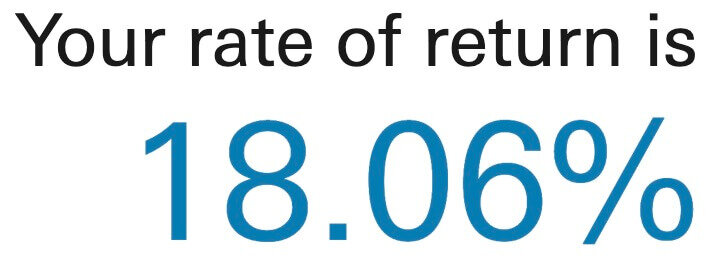

Returns Since Inception (+18.06%)

I count inception as the first full month I had my Vanguard account open, the end of May 2018. From then until now (the end of August 2020), my investments grew by a non-annualised 18.06%.

Annual Return (+5.72%)

From August 2019 to August 2020, my Vanguard investment portfolio grew by 5.72%.

Sector Breakdown

Here’s how my investments are broken down by sector/industry, plus how the sector allocations have changed since last month (+/-%).

As last month, the largest portfolio change in August was the Tech sector (+0.7%). Oil and Gas continues to decline (from 3.7% in June, to 3.5% in July, to 3.3% in August).

Technology: 20.6% (+0.7%)

Financials: 17.7% (-0.2%)

Industrials: 12.6% (no change)

Consumer Services: 12.4% (+0.3%)

Health Care: 12% (no change)

Consumer Goods: 10.5% (+0.2%)

Basic Materials: 4.2% (+0.2%)

Oil & Gas: 3.3% (-0.2%)

Utilities: 3.2% (+0.1%)

Other Sectors: 3.3% (-1.2%)

If you want to know more about how these sectors are defined and differentiated, I’ve given details in the report from July 2019.

Geography

Below, you can see how the Vanguard FTSE Global All Cap is invested around the world.

North American investments continue their upward trend as last month (the biggest gain in my portfolio of 1.05%). The cash allocation of the FTSE Global All Cap saw the biggest drop (from 1.98% to 0.78% this month).

North America: 59.33% (+1.05%)

Asia/Pacific: 13.38% (+0.47%)

Europe: 12.16% (+0.05%)

Japan: 6.88% (-0.39%)

UK: 3.97% (-0.08%)

Middle East/Africa: 1.8% (-0.02%)

Central/South America: 1.01% (+0.07%)

Cash: 0.78% (-1.2%)

Eastern Europe: 0.46% (no change)

Other: 0.25% (+0.01%)

Individual Investments

The Vanguard fund that I’m invested in holds over 6,600 stocks across the globe, in companies of varying sizes (from small to large). August saw Apple overtake Microsoft as the largest investment (now 3.1% of the Global All Cap portfolio).

We’re still waiting on news about the inclusion of Tesla (TSLA) in US and global indices. If and when it does join, it’ll likely make up greater than 1% of the S&P 500 and near or around 1% of a global portfolio.

There’s no doubt about it, there is no historic precedent for a company of Tesla’s size joining global indices. Historically, companies have met index inclusion criteria long before market dominance.

Apple: 3.1% (+0.4%)

Microsoft: 2.7% (-0.1%)

Amazon: 2.4% (+0.3%)

Alphabet: 1.6% (no change)

Facebook: 1.1% (+0.1%)

Alibaba: 0.8% (+0.1%)

Tencent: 0.7% (no change)

Johnson & Johnson: 0.7% (no change)

Berkshire Hathaway: 0.7% (+0.1%)

Taiwan Semiconductor Manufacturing: 0.6% (new)

My portfolio concentration in the top 10 stocks stands at 14.4%, up 0.9% from last month.

FreeTrade Investments

As for my FreeTrade investments, I’m continuing to sell any free referral shares earned and buy into VWRL (The Vanguard All-World ETF).

I’ve been given an unlimited use FreeTrade referral link which gets both of us one free share (worth between £3 - £200) when you sign up to a free account and deposit £1.

And thanks to you lovely people for using the referral link above, I’ve earned enough in free shares to buy another VWRL share.

So, at the end of August, my FreeTrade portfolio was worth £225 (£217 in VWRL + £8 in cash), up from £189 in July and the value of VWRL had increased by 3.19%.

Trading 212 Investments

As I’m doing with FreeTrade, I’m selling any free Trading 212 referral shares and buying into VWRL. Unlike, FreeTrade, 212 allows you to buy fractional shares so I have no cash accruing in my Trading 212 portfolio. It’s all just converted to VWRL straight away.

Get your own free Trading 212 share worth up to £100 through my referral link when you sign up for free and deposit £1.

In the month of August, I earned a share in National Grid (NG) which I converted over to VWRL.

At the end of July, the account was valued at £152.49. It’s now worth £167.76 (with no cash allocation - 100% VWRL).

Tickr Investments

Tickr is an investment app which focuses on environmentally and socially responsible investing.

Get £10 and 2 trees planted when you download the app with this referral link

Last month I decided to invest in my Tickr referrals. There are 4 different funds to choose from, 3 of which have a specific focus, 1 is a combination of all 3.

The 3 themes on offer are Climate Change, Equality and Disruptive Technology. You’ll be investing in companies which tackle issues related to each theme. I chose a combination of the 3 "(the Combo fund) and I selected ‘Adventurous’ risk level as I’m happy with a greater equity proportion.

My portfolio is currently valued at £34.79. The fund allocates a large proportion of its portfolio to equities in a range of sectors (eg. Digitalisation, Automation, Clean Energy, Global Water) and a small proportion in less risky Cash, Green bonds and Government Bonds.

Dividends

My Vanguard Portfolio is accumulating. This means any dividends earned go back into the fund (an important aspect of long term investment growth).

My VWRL ETF investments (in FreeTrade and Trading212) are dividend producing. I am yet to be paid any dividends but I have decided to reinvest the income produced by these investments back into VWRL. This allows me to take advantage of the long term growth attributed to dividend reinvestment.

Recommended Resources

If you’re looking for resources to better your own personal finances, here are some of my recommendations:

Facebook - UK Passive Investing Group - Join a like-minded community of UK Passive Investors (both professionals and newbies).

My referral offers page. Grab free stocks, free money, free points, discounts and free products.

Rich Dad, Poor Dad by Robert Kiyosaki

The Little Book of Common Sense Investing by John C Bogle

The Intelligent Investor by Benjamin Graham

The best UK free share referral offers, updated throughout December 2025. Get free stocks and shares with Shares App, FreeTrade, Stake and more.