Vanguard UK, New ESG Funds And Greenwashing?

/Vanguard UK has just launched 2 new ESG funds. Funds that are designed to exclude certain companies based on environmental, social and governance (ESG) standards. So, what are the details? And, Are Vanguard ‘greenwashing’?

The launch of the 2 new ESG funds brings Vanguard’s total ESG offering to 4. The last 2 were launched all the way back in 2011.

These are, by no means, investment recommendations. Before making any investment decision, you must do your own research and/or speak to a professional.

What Are The 2 New ESG Funds?

The Emerging Markets ESG fund is clearly a new offering. But you might be wondering. What’s the difference between the new Vanguard ESG Developed World Fund and the original ESG Developed World Fund?

The reality? Likely not much. The original (2011) fund is domiciled in Ireland. The new offering is domiciled in the UK. What difference does that make? To the average investor, it will probably make little to no difference. Fund domiciles are selected based on tax efficiency, costs, economies of scale and investment strategy, amongst other criteria.

I’d suggest talking to a tax advisor if you really want to go down that rabbit hole. But, for most, it will likely make little difference.

Breaking Down The Fund Names

Breaking down a fund’s name is a quick and useful way to learn about it’s underlying portfolio.

Vanguard ESG Developed World All Cap Equity Index Fund (UK)

“ESG” - The fund uses environmental, social and governance standards to exclude certain stocks

“Developed World” - Advanced, developed countries (not emerging markets)

“All Cap” - Large, mid-sized and small companies

“Equity” - Stocks, not fixed income like government or corporate bonds

“Index Fund” - Aims to replicate a benchmark stock market index

“UK” - Domiciled in the UK

Vanguard ESG Emerging Markets All Cap Equity Index Fund

“ESG” - The fund uses environmental, social and governance standards to exclude certain stocks

“Emerging Markets” - Developing nations, not advanced, developed economies

“All Cap” - Large, mid-sized and small companies

“Equity” - Stocks, not fixed income like government or corporate bonds

“Index Fund” - Aims to replicate a benchmark stock market index

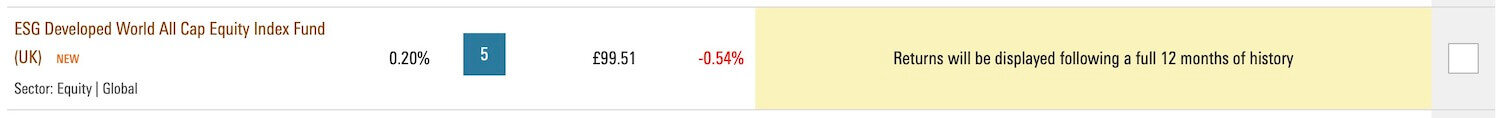

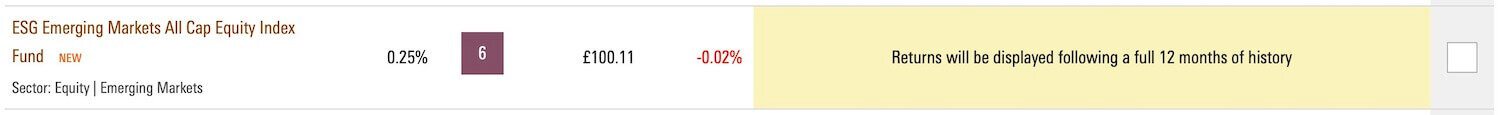

What Are The Ongoing Fees For The New Funds?

Fees, of course, are extremely important to long term wealth creation. Compounding, sadly, occurs on fees too over time. You’ll want to keep investment fees as low as possible. As you’d expect (the late Vanguard founder John Bogle pioneered low cost index investing) the 2 new funds keep costs low.

ESG Developed World All Cap Equity Index Fund (UK) - Ongoing Fund Charge (OCF) = 0.2%

ESG Emerging Markets All Cap Equity Index Fund - Ongoing Fund Charge (OCF) = 0.25%

Performance Compared To Non-ESG Versions

Since the funds have only just launched, you can’t look back directly at historic performance. But you can look back at the performance of the benchmark indices that they are tracking.

You can also compare the performance of the ESG version to the non-ESG version, that doesn’t exclude companies based on ESG criteria.

ESG Developed World All Cap vs Non-ESG Developed World All Cap (29th May 2020)

ESG 1 Year Return = 13.3% (Non-ESG = 8.4%)

ESG 3 Year Return (Per Year) = 9.6% (Non-ESG = 7.4%)

ESG 5 Year Return (Per Year) = 12.2% (Non-ESG = 10.6%)

ESG Dividend Yield = 2.18% (Non-ESG = 2.48%)

ESG Emerging Markets All Cap vs Non-ESG Emerging Markets All Cap (29th May 2020)

ESG 1 Year Return = -2.5% (Non-ESG = -5%)

ESG 3 Year Return (Per Year) = 0.2% (Non-ESG = 0.3%)

ESG 5 Year Return (Per Year) = 0.7% (Non-ESG = 0.8%)

ESG Dividend Yield = 2.66% (Non-ESG = 3.27%)

Top Stocks, Countries and Sectors

Similarly, you can look at the benchmark indices to compare the top stocks, countries and sectors in each index.

ESG Developed World All Cap - FTSE Developed All Cap Benchmark (29th May 2020)

Top Stocks = Microsoft (3.7%), Apple (3.5%), Amazon (2.7%)

Portfolio Concentration = The top 10 stocks account for 17% of the entire portfolio

Top Countries = USA (66.4%), Japan (9%), UK (3.7%)

Top Sectors = Tech (23%), Health Care (15%), Industry (9.3%)

ESG Emerging Markets All Cap - FTSE Emerging All Cap Benchmark (29th May 2020)

Top Stocks = Alibaba (8.43%), Tencent (6.98%), Taiwan SM (5.4%)

Portfolio Concentration = The top 10 stocks account for 30% of the entire portfolio.

Top Countries = China (44.4%), Taiwan (18%), India (8%)

Top Sectors = Tech (22%), Banking (16%), Retail (15.8%)

What Do The Funds Exclude Based on ESG Standards?

Both funds exclude stocks based on the same ESG standards. According to Vanguard, these funds exclude:

Non-Renewable Energy Stocks - Companies that own coal, oil or gas reserves. Companies that make money from nuclear power (directly or indirectly) and companies that support the non-renewables sector.

Vice Products - Adult entertainment, alcohol, gambling and tobacco stocks.

Weapons - Civilian and military weapon stocks.

Controversial Conduct - Companies that don’t meet UN labour, human rights, environmental or anti-corruption standards.

According to FTSE, who is responsible for the exclusion criteria:

The ESG Developed World All Cap Index excluded 868 stocks from the parent, non-ESG index.

The ESG Emerging Markets All Cap Index excluded 818 stocks from the parent, non-ESG index.

Are Vanguard ‘Greenwashing’?

Here’s where things go from simple black and white, to the grey pragmatic reality. And it’s why you need to be careful when you’re looking at ESG funds to invest in.

On the launch of the two new funds, Vanguard’s blog post highlighted that the new funds…

“exclude companies that fail to meet independently established environmental, social and governance (ESG) standards. This includes but is not limited to fossil fuel companies, producers of weapons and the tobacco industry”.

But there is a discrepancy here.

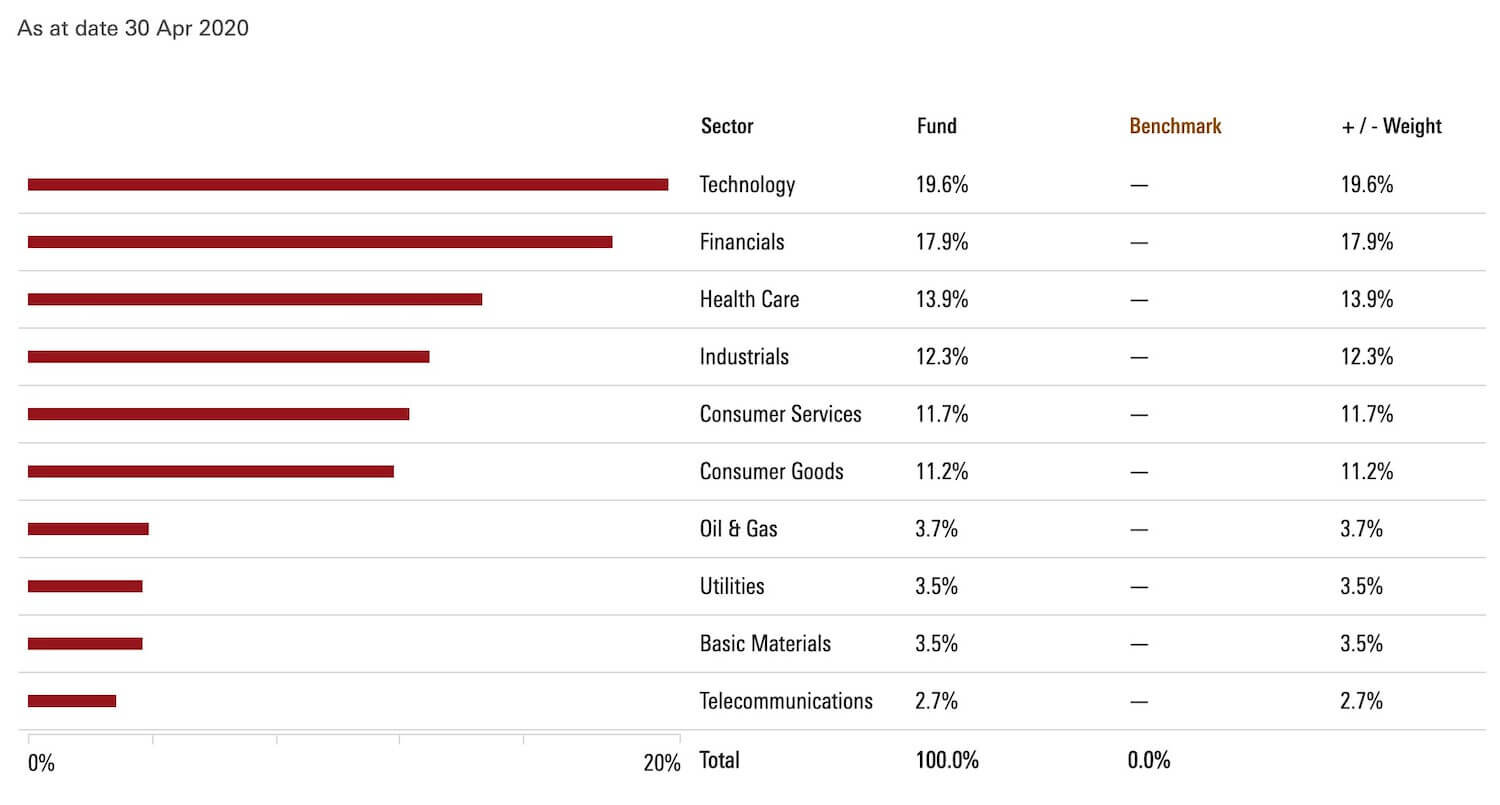

3 of Vanguard’s 4 ESG funds specifically mention the exclusion of non-renewable energy stocks. But if you dig into the details of the Developed World ESG fund, 3.7% of the portfolio is invested in the Oil & Gas sector.

The new fund’s portfolio data is not yet available but since their portfolios should match, you can only assume that’s also the case with the new, UK-domiciled version.

The 2011-launched European Stock SRI fund objectives are similar but slightly more vague. “The criteria take into consideration environmental, social and ethical factors as determined by the Index provider and exclude stocks that violate United Nations Global Compact principles.”

5.8% of the European Stock SRI fund, as of the 30th of April 2020, is invested in Oil & Gas.

A second discrepancy emerges when you compare the ESG Developed World Index Fund with the FTSE benchmark it’s tracking. The fund contains 3.7% Oil & Gas stocks according to Vanguard (30th April 2020) but the benchmark only contains 0.12% Oil & Gas (29th May 2020). Granted, there’s a one month difference, but that doesn’t explain that significant of a divergence.

FTSE and Vanguard do classify their stocks differently. FTSE breaks this particular fund down into 19 categories, Vanguard only breaks it down into 10. That’s one possible explanation. But if you’re an ESG investor who thinks they’re divesting from Oil & Gas, when you’re not, that’s a problem.

Vanguard clearly sees ESG as an opportunity for growth, as investors are becoming more conscious of their portfolios. But with over £260 million in assets between their 2 original ESG funds, you have to ask yourself whether the investors that placed it there in the first place were fully conscious of the details of their investments.

My advice? Always dig into the details. If you’re investing your hard-earned money, know what it costs and know where it’s going.

Let me know your thoughts in the comments section down below and, if you like reading or talking about UK passive investments, come join our Facebook group ‘UK Passive Investing’.