Keeping Track of Your Money: An Illustrated Guide

/Unclaimed Financial Assets in The UK

According to the Unclaimed Assets Register (UAR), there is an estimated £15-20 billion sitting in unclaimed financial assets (unclaimed money) in the UK. Assets can be separated from their owner in multiple circumstances (eg. death, failure to notify a company of a change of address).

Keeping track, notifying your family/partner of your assets and keeping all that information in one place is important.

What’s more, The ‘Dormant Bank and Building Society Accounts Act 2008’ grants banks and building societies the ability to transfer money held in dormant accounts to a central reclaim fund. A ‘dormant account’ is classified as such when no customer-initiated activity occurs for more than 15 years. Whilst dormant money can be reclaimed at any time by the owner, a large proportion of these assets will likely never be reclaimed.

The central reclaim fund is responsible for managing dormant assets, granting reclaims and passing on any surplus to the Big Lottery Fund. According to the central reclaim fund, as of the 31st of December 2017, £1,098,700,000 (thats just under £1.1 billion) of dormant account money has been transferred from participating banks and building societies. £65,740,000 (that’s just under £66 million) has been reclaimed by owners.

That is a reclaim rate of just under 6% (up until the 31st of December 2017). Around £362 million of surplus has been transferred from the central reclaim fund to the Big Lottery Fund.

Keeping track of your savings and investments, keeping a record of everything in one place for simplicity, can help stave off the chance of this happening to you.

Track Your Savings and Investments

I have been tracking my savings and investments, on a monthly basis, since I was around 19 years old. I started for two major reasons. Firstly, I wanted to track my net worth and secondly, I wanted to see if tracking it would encourage me to save more. It was a simple idea but it had a surprisingly powerful effect.

Seeing a dip on a graph which tracks your savings will make you stop and think. Even if you don’t actively alter your behaviour, it will probably change anyway. And that is a good thing. I was convinced, from month one, that this was a good idea.

How To Use A Spreadsheet To Track Your Assets?

am aware that there are apps designed to do this for you but, to me, a spreadsheet is still the best tool. You can see everything on one page, you can add in useful data and forget any data that you don’t really care about.

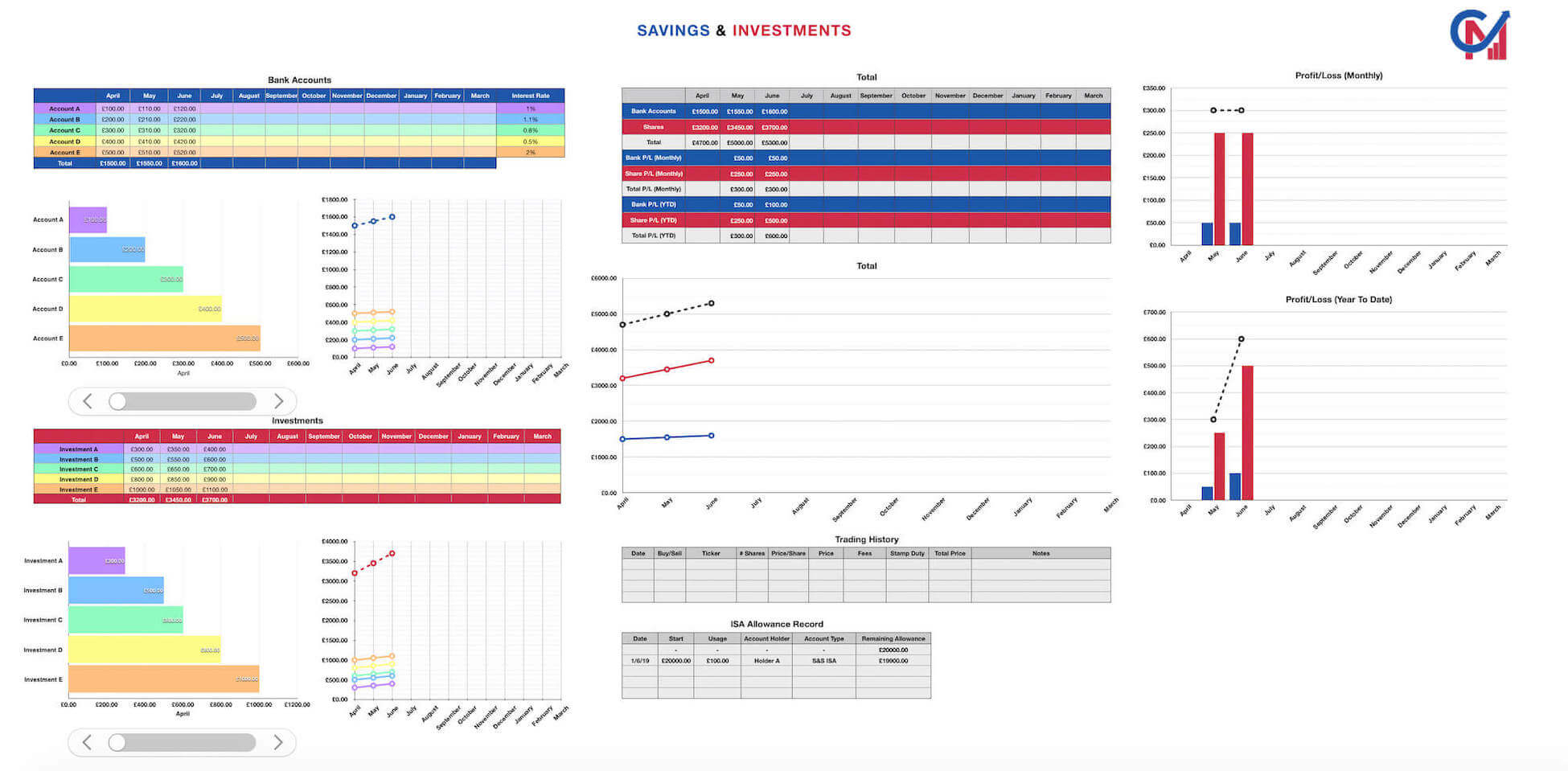

When I started out, the spreadsheet was really simple. I would look up my account balances and then write them down in a table. Over time I started tracking interest payments separately, investments, I added in a section for ‘Profit/Loss’ (monthly) and ‘Year-To-Date’ information.

Honestly, at one point I got a bit carried away. I had so many sections that the task of inputing all the data at the end of the month was quite daunting. I have learned from that and scaled it back since then. I use some methods to speed up the process and it now takes about 15 minutes maximum to fill it all in.

Do A Monthly Net Worth Update

I update the spreadsheet you can see above on the last day of every month to keep things simple. I could have picked any day but the important thing is to pick a day and stick to it. The data should represent how your account balances change month-to-month so the time period between each update needs to remain constant.

If you were to update sporadically, you wouldn’t get an accurate display of this change over time since the period you are measuring in which you earn/spend money would change.

I also complete one spreadsheet every UK tax year from the last day of April to the last day of March.

Track Bank Account Savings

I check all of my bank accounts and note down the balance of each one, under the appropriate month. Once I’ve done that, the spreadsheet is setup so that it automatically updates other graphs and tables, like the ‘Totals’ graph.

I used to manually login to online accounts to view my account balances. But now most of my account balances can be accessed via a mobile banking app. This is, by far, the quickest way to find out and fill in this information.

Track Investments In Investment Accounts

This is similar to the ‘Bank Accounts’ table. I input the investment name on the left and the current value (eg. share price x number of shares). The ‘Totals’ section and a number of graphs automatically populate.

Keep Track Of Total Assets

I do not have to manually input data to this section. Instead, I have setup the spreadsheet so it carries over the totals from the ‘Bank Account’ and ‘Investment’ sections. The table automatically calculates the monthly profit/loss for my bank accounts and investments so I can check increases/decreases in my net worth.

Profit/Loss (P/L) is determined by taking the total from one month (eg. June) and subtracting the total from the previous month. If the difference is positive, the assets have increased in value (profit). If it is negative, the assets have decreased in value (loss). The ‘Total P/L’ takes into account the P/L from my bank accounts and investments combined.

The Year to Date (YTD) profit/loss rows display how my bank account and investment balances have changed since the start of the year (April). It subtracts the April total from the current monthly total (eg. July Total P/L YTD: £8000 - £6000 = £2000).

Profit/Loss Bar Chart

These charts, like the others, will automatically populate based on the data you input in the first two tables (Bank Accounts and Investments). One chart displays the profit/loss month-to-month and the other displays profit/loss from the start of the year (YTD).

I think it makes sense visualising this information in multiple ways as it helps reinforce saving.

Conclusion

Tracking your finances in some way is important. You need to know what you have and you need to know where it is. Additionally, just knowing how your financial situation changes month-to-month and having a visual representation of that can help you develop a savings mentality.

References

Unclaimed Assets Register - Unclaimed Asset Figures

2014 UK Government review of the 'Dormant Bank and Building Society Accounts Act 2008'

The best UK LEGO Deals and Promo Sets that you can get right now in February 2026 from a range of trusted online retailers. Updated daily.