How To Track and Increase Your Credit Score

/Your credit score matters. Your score makes it or breaks it when it comes to applying for financial products like credit cards, loans and mortgages. The UK has 3 main credit reference agencies, TransUnion (formerly Callcredit), Equifax and Experian, and annoyingly they all have different measures for determining your score. The highest score possible, also differs between agencies.

TransUnion Maximum: 710

Equifax Maximum: 700

Experian Maximum: 1000

My Experience With Credit Scoring

I started caring about credit scores when I was around 19 years old. As a young person who aims to own their own home, I learned about how having a good score can affect your mortgage interest rate. When it comes to mortgages especially, every small number counts. Here are some back-of-the-napkin calculations:

Lets take a house costing £200,000. If you pay a 10% deposit (£20,000), you will have a total mortgage debt of £180,000. For an average term of 25 years, with a repayment mortgage (not interest only) here is how reducing the interest rate even slightly, can affect how much you pay.

Rate: 2% = Monthly Payment of £763, Total Repayment + Interest of £228,922

Rate: 1.9% = Monthly Payment of £754, Total Repayment + Interest of 226,348

*This example does not include any fees associated with mortgage/house purchasing

In this case, a difference of 0.1% is equal to the sum of £2574.

This is the way I looked at this. Increasing my credit score, can give me access to better rates of interest. As I write this, interest rates are beginning to rise and so paying attention to this is becoming much more important. One of the best things you can do to prepare is to maximise your credit score early on.

Tracking Your Credit Score For Free

Don’t ever pay to view your credit score!

There are numerous ways to track your credit score, with all three major agencies, for free. Here are my recommendations for your score with each agency:

ClearScore - To track your Equifax credit score for free

Noddle - To track your TransUnion credit score for free

MSE Credit Club - To track your Experian credit score for free (+ card acceptable eligibility and affordability score)

Increasing Your Credit Score

I have steadily increased my credit score by following these guidelines:

Guide To This Chart

The dark green (left) refers to the best case scenario and the red (right) refers to the worst case scenario.

Payment History:

Keep this to 100%. I could have paid the minimum balance but I pay the balance off in full every month so I don't have to pay interest. The gains of having a credit card (points/cashback etc.) are usually lost if you pay interest. This chart shows how being late on only one payment can negatively affect your score for a long time. Plus, there is usually a late fee on top.

Derogatory Marks:

Eg. Bankruptcy, Foreclosure. These are surefire ways to ruin a number of your financial relationships

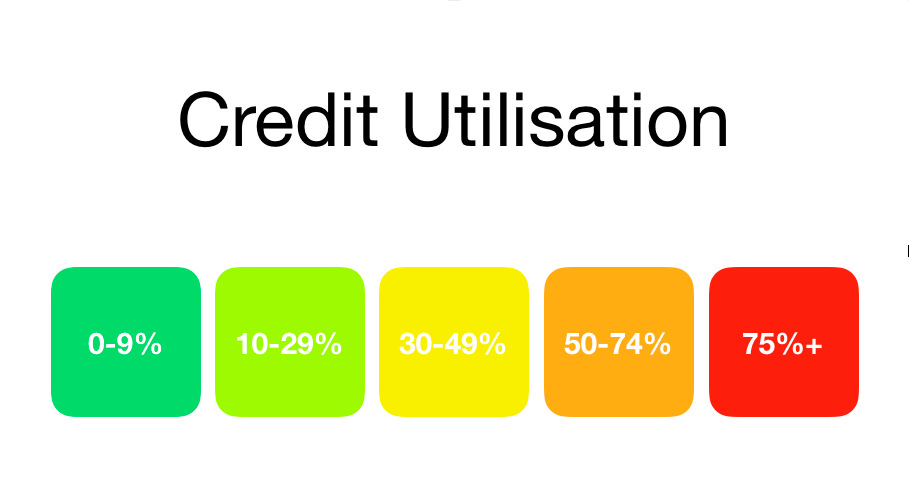

Credit Utilisation:

This is how much you owe when your statement comes in compared to how much credit you have access to across all your accounts. If I had access to £1000 credit and I owed £100 at the end of the month, my utilisation would be 10%. Keeping it as low as possible is best for your score.

One trick I use if I want to use my cards for most payments (to earn points) is to pay off some of the balance before my statement comes in. For example, if I had spent £500 on the Amex card and my statement was generated on the 9th of the month, I would go on the Amex website or use the Amex app to pay off most of the balance. If I left a balance of £10 in the account, that would be reported as a utilisation of 1%.

I always kept a small balance as it is good to have something on the statement to pay off. This generates a repayment history which is good for your score.

Credit history Age:

I only opened a credit card account less than one year ago so the 9+ year optimisation is impossible for me. This one is just a case of waiting for complete optimisation. Here is where keeping accounts open even if you don't want to use them can be useful.

For example, my capital one card was only opened to increase my score before getting a better card. I could close the account but my average age of accounts will drop as it only applies to accounts currently open. Some card issuers close accounts if they have been inactive for a period of time so I use my capital one card for one small purchase every month or two.

Credit Inquiries:

This one can be the catch 22 when you are starting out. You need a decent score to open an account but you tend to need a credit history before opening an account with rewards/cashback. A hard credit inquiry occurs when you apply for a credit card/loan/mortgage and similar products. I wanted to make sure I would be accepted so I only applied, at the start, for a basic credit building account (Capital One).

Some sites online like MoneySavingExpert and MoneySuperMarket allow you to input your details and gauge your chance of being accepted to credit cards. They do this by doing a soft search of your credit history which does not affect your score.

When I applied for my Amex card, I used sites like these to give me an indicator of my chance of acceptance. I applied for the card, where a hard credit inquiry would take place, when my chance of acceptance reached 90% or over.

In future, to keep hard inquiries to a minimum, I will only apply for a maximum of 2 cards per year, spaced 6 months apart. And if I am planning on getting a mortgage, I will cease applications for at least 12 months before applying.

Conclusion

In my opinion, optimising these factors is important to do as early as possible. If I plan to buy a house at some point in the next 3-5 years, boosting my score now and over the next few years could save thousands of pounds of interest in the long term. It also gives me access to good credit cards with good cashback and rewards in the short term.

If you liked this post, hit the like button down below. If you want to contribute to the discussion you can do so in the comments section down below.

The best UK LEGO Deals and Promo Sets that you can get right now in December 2025 from a range of trusted online retailers. Updated daily.