The Halifax Reward Account - Is It Worth It?

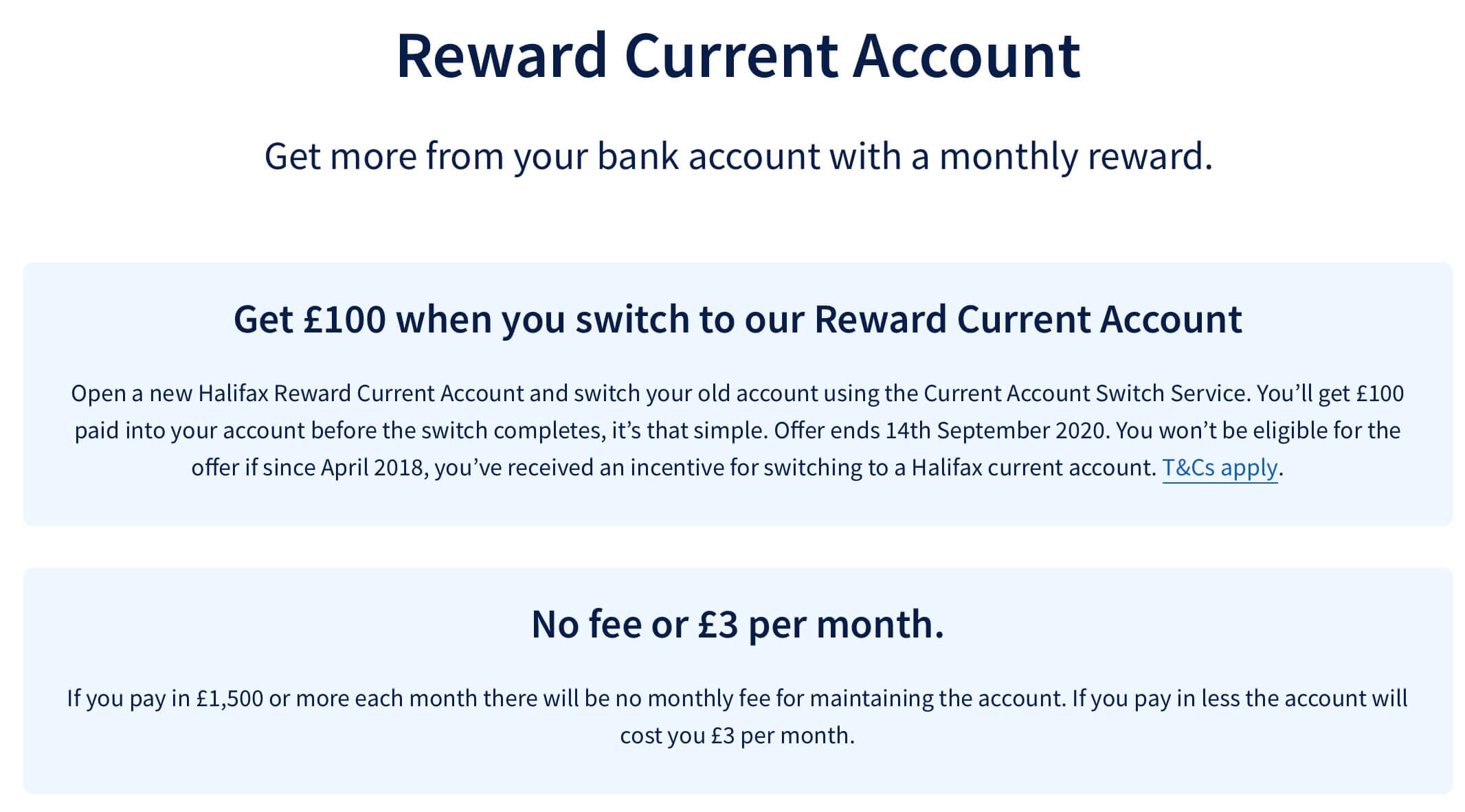

/[7th of September Update] The Halifax Reward account is offering a generous £100 switching bonus if you open an account and complete a current account switch by Tuesday 8th of September.

Along with the switching bonus, you also get to choose from one of four rewards (if you meet certain requirements). In this guide, I’ll go through the reward options (along with the account requirements) to help you figure out what offers the best monetary value.

The Halifax Reward Account Terms

Monthly Fee of £3 - Waived if you pay in £1,500 per month (if you can’t meet that requirement through income, you can simply transfer in and out £1,500 every month from another account to meet the requirement)

Monthly Rewards - To get one of the 4 rewards (outlined below), you need to keep a balance of £5,000+ in the account or spend £500 on the debit card each month.

Is It Worth Meeting The Requirements To Get The Monthly Reward?

Here’s why it might not be. Let’s look at the options:

Spend £500 on Your Debit Card Each Month?

Firstly, you’ll want to make sure you’re not inflating your spending in order to reach the £500 minimum. And that’s sometimes hard to gauge to because behavioural economics come into play.

Spending, especially when incentives come into play, can consciously or unconsciously boost your spending. If you’re spending more to get one of the 4 rewards, it’s unlikely it’s worth it (due to the value of the rewards (see below for details).

Halifax do offer up to 15% cashback on certain spending (can include Co-Op, Costa, Hilton and Sky) so you’ll need to take into account where you spend your money.

But other accounts do offer generous points and rewards on spending. When done effectively (check out my guides on Amex and Tesco Clubcard) this can really increase your savings).

This means it might be better to spend using other means than spending with the Halifax card to get one of their rewards.

Maintain Account Balance of £5,000+

This is a lot easier to maintain (if you have access to the capital). But the problem here is that you’d be storing £5,000 in a 0% interest rate account in order to get one of the rewards.

You would get £60 over the course of the year if you took the £5 monthly cash option (boosted value if you choose another reward).

£5 is equivalent to an interest rate of 1.2% (if you don’t story a penny over £5,000).

For comparison, NS&I currently offer an easy access savings account with 1.16% interest. There are no potential monthly fees and the min deposit is £500.

Halifax Reward Options

Outlined below are the 4 Reward options that Halifax offer.

£5 Cash

What Do You Get? Simple, £5 cash, every month

Value: £5 per month (£60 per year)

2x Digital Movie Rentals with RakutenTV

What Do You Get? 2 HD or SD film rentals (not UHD) per month through RakutenTV.

Validity: Codes valid for 35 days.

Value: £10 per month (£120 per year)

3 x Digital Magazines

What Do You Get? 3 digital magazines per month (Cosmo, Country Living, ELLE, ELLE Decoration, Enquire, Good Housekeeping, Harper’s Bazaar, House Beautiful, Men’s Health, Prima, Red, Runner’s World, Women’s Health)

Validity: Codes valid for 12 months.

Value: Ranges (around £10 per month dependent on the Magazine - £120 per year)

1 x Vue Cinema Ticket

What Do You Get? One free cinema ticket per month at Vue (2D/3D/Xtreme) including VIP seats + Half price popcorn

Validity: Codes valid for 12 months

Value: Around £8-£17 for the ticket + 1/2 price popcorn (location, film and seat dependent) so £96-£204 per year.

Which Halifax Reward Offers The Best Value For Money?

In terms of Value, the Vue cinema ticket (depending on location) likely offers the best value for money, followed by the RakutenTV film rentals, Magazines and then the direct £5 cash.

The best UK LEGO Deals and Promo Sets that you can get right now in January 2026 from a range of trusted online retailers. Updated daily.