Lump Sum vs Drip Feed Investing

/Let’s say you have been saving for a while and now you are looking to invest a portion of your savings. In another scenario you might have come into a sudden windfall of money from an inheritance, gift, pension fund lump sum etc.

When you have a large pot of money to invest, you have two main choices. You can either invest it in one big lump sum payment or you can take that sum, split it up and invest it over time. What are the advantages/disadvantages of both options and what should you take into account besides the present and potential value of your investments?

What Is Pound Cost Averaging?

Pound Cost Averaging (PCA), the UK equivalent of dollar cost averaging, is the technique where you divide your lump sum into portions and drip feed that amount into the market. Look at the graph below. You can see how PCA can benefit you in a falling market.

PCA allows you to buy more shares if the share price decreases, leading to a portfolio with greater value when the share price rebounds.

PCA Benefits You If The Market Falls

In the figure below I am using the example of someone with £10,000 to invest. If the investor invests everything immediately in month one (light green), when the share price (yellow dotted line) is £100, in 10 months time they will still have the same number of shares (100 at £100 each = £10,000 value). This is the lump sum method.

If the investor used PCA (dark green) and drip-fed £1000 into the market on a monthly basis, the end result would be somewhat different. The investor would be buying more shares per £1000 when the price decreased.

You can see their gradual number of shares increase over time (as opposed to the lump sum investor's fixed number). The end result in this case is an investment valued at £11,300 (113 shares at £100 each). In this example PCA led to a higher rate of return but only since the market declined whilst he was using the technique.

Lump Sum Vs Drip Feeding: Which Has Faired Better?

A study published by Vanguard compared the returns you would have received if you had invested a lump sum immediately vs if you had drip-fed a lump sum over a period of 12 months. They looked at 3 types of portfolios. 100% stocks, 50/50 stocks/fixed income and 100% fixed income. And they looked at the data from 3 markets. The USA from 1926 to 2015, the UK from 1976 to 2015 and Australia from 1984 to 2015.

They looked at the difference in returns between the lump sum and drip feeding approaches. You can see the results below. Take into account that the example assumes a few things. Firstly, trading in the local currency. Secondly, it includes dividend reinvestments (also known as the total return). And finally, no transaction costs/taxes.

Lump Sum Beats Drip Feeding 65% Of The Time

No matter how the assets were allocated, over 65% of the time, the returns from the lump sum approach (blue) beat those from drip-feeding (green). In other words, around two-thirds of the time you would have been better investing everything all at once, rather than drip-feeding.

Of course that means that around one third of the time you would have had higher returns overall by drip-feeding. This only occurs if the market is in decline whilst you are drip-feeding, allowing you to benefit from lower prices before a market bounce-back.

Use Drip-Feeding As Insurance Against A Falling Market

Since most investors looking to invest a pot of money drip-feed as an insurance against a market crash or decline, let’s look at some of the cases where it pays off. Take the bottom 10% (decile) of 12-month periods by portfolio performance in these 3 markets.

This would be the decile (10% band) that includes various stock market crashes across the 3 markets observed here. The average outperformance of drip-feed investing in this decile is around 8%. If you had taken the systematic approach during these periods, this idea of drip-feed insurance would have paid off.

The reverse is true if you had invested a lump sum prior to a bullish (rising) market. If you invested lump sum prior to the top 10% of years by market performance, this method would have dealt an average outperformance of over 10%. The average outperformance of lump sum investing across all 12 month periods is around 2%, dependent on the market.

Cash Drag Can Decrease Your Long Term Returns

If you decide to take the systematic, drip-feed approach, you have to take into account the phenomenon known as cash drag. Cash is not king in terms of return on investment so cash can drag down the ultimate return of your entire portfolio. Let’s say you have a target portfolio of 70% stocks, 30% bonds. You decide that you want your full lump sum investment of £12,000 to be divided into 12 equal portions and invested monthly. In 12 months time, you will have achieved your target portfolio.

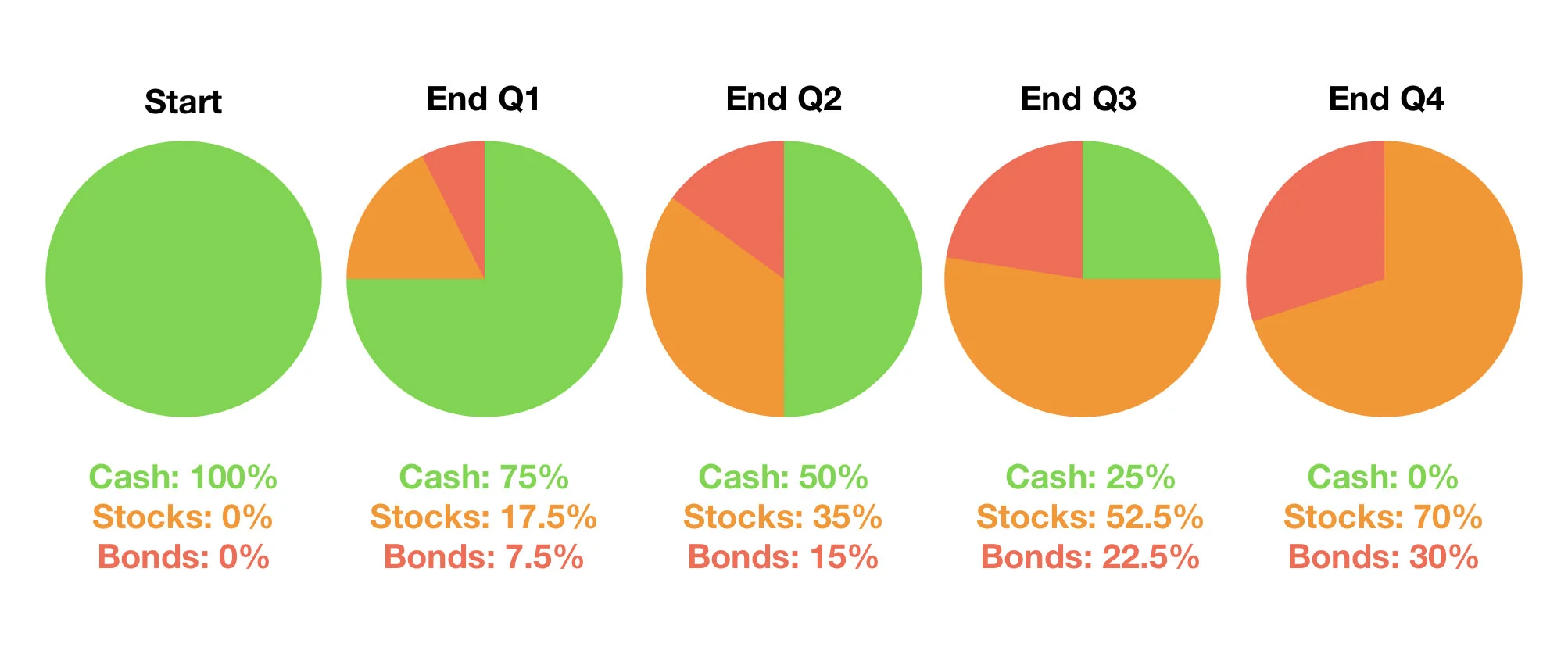

However, in the meantime your portfolio will actually include a large cash segment. Over the year the cash segment of your portfolio will steadily decline until you reach your target. The figure below is an illustration of what this could look like. Bare in mind this example assumes no market fluctuations.

By the end of the first quarter (Q1), 75% of your portfolio is still in cash. This decreases, whilst the stocks/bond segments increase as your invest that cash. By the end of the year (Q4), your target has been achieved and the cash has been invested.

The Psychological Aspect Of Drip Feeding

One aspect you need to take into account with this question is behavioural finance.

The more the market declines whilst you drip-feed, the better the returns will be in the long term, because you’re buying low. But the examples above assume that, no matter what, you are investing the amount that you set out to invest on a regular basis.

So your actions, as a human being, have to be taken into account here. If the market drops significantly whilst you’re investing, you have to ensure you will still regularly invest.

Let’s take an extreme example.

Imagine you were lucky enough to decide to drip-feed rather than invest lump sum from the beginning of March 2008 to the beginning of March 2009 (S&P 500 Index - Total Return).

You would have had to continually invest as you witnessed the market decline by over 45%.

You have to ask yourself, would you manage to stick to your plan? This is an extreme example but a possibility nonetheless. A possibility that you are actually planning for when you decide to drip feed.

Automation Can Help Control Your Behaviour

This is where I would like to bring up the benefits of automation. If you have to manually deposit money and invest during a falling market, you are more likely to stick to your plan if you automate the process.

If you automate a regular deposit from your bank account and set up automatic investments, this can insure you against your emotions. Of course this depends on how your investment platform works.

Another psychological aspect is more positive. Drip-feeding can help develop a savings habit. Hopefully, after the lump sum has been invested completed, you will continue to invest on a monthly basis.

Keep Fees and Taxes As Low As Possible

This will be dependent on a few things. If you are planning on investing through a stocks and shares ISA (tax free wrapper), your total annual contribution must not exceed the annual ISA allowance. This will be the case if you use the PCA or the lump sum method.

If you’ve contributed above your ISA limit this tax year, you can always transfer your investments into an ISA in a later tax year, using the Bed & ISA method.

Also, always take into account charges/fees. If you are charged transaction fees, drip-feeding will incur additional charges over time. However, some investment platforms do not charge transaction fees when buying shares/funds/ETFs etc. Check to see if this is the case with your provider. Vanguard UK, for example, offer free dealing with their ETFs and funds.

There Is No Correct Answer

There is no correct answer to this question. It is possible your returns will be greater using PCA and it is also possible your returns will be greater investing lump sum. Before you decide, I would say these are the most important things to take into account.

I think it is better to be in the market than out of it, based on the historical long term returns of equites/bonds over cash. But the problem of course, is in how and when you enter.

If you invest lump sum and the market declines over the next 12 months, will this affect you psychologically? Will this deter you from investing in the future?

If you use PCA, you are effectively buying insurance. Sometimes the insurance pays off and sometimes it just costs you. If you do decide on PCA, the most important thing is to make a plan and stick to it.

I used the drip-feed approach, rather than the lump sum method when I started investing.

Do you have a pot of money you want to invest? What approach are you thinking of taking? Let me know in the comments down below. I respond to all comments.

If you’re looking for resources to better your own personal finances, here are some of my recommendations:

Get 1 Free Share With FreeTrade - Sign up for free to the FreeTrade investing app and get 1 free share (up to £200 value) with my referral bonus.

Savings/Investment Spreadsheet Downloadable - 10% of profits go to a charitable cause.

Facebook - UK Passive Investing Group - Join A Like-Minded Community

Check out my offers page to earn some free money and grab some freebies.

Rich Dad, Poor Dad by Robert Kiyosaki

The Little Book of Common Sense Investing by John C Bogle

The Intelligent Investor by Benjamin Graham

References

Shtekhman, Anatoly, Christos Tasopoulos, and Brian Wimmer, 2012. Dollar-Cost Averaging Just Means Taking Risk Later. Valley Forge, Pa.: The Vanguard Group.

The best UK free share referral offers, updated throughout February 2026. Get free stocks and shares with Shares App, FreeTrade, Stake and more.