My Passive Investments - September 2018 (-0.22%)

/A short term look on long term investing

This is my fourth report on my own passive investment portfolio. Firstly, my investment decisions are exactly that, my own. As as UK-based investor, I based each investment decision on my own research. These are, by no means, investment recommendations. Before making any investment decision, you must do your own research and/or speak to a professional.

Why Do A Report?

You can read more about this in my first passive investor report, which I made back in June 2018.

My Passive Investments Strategy

Long term, my aim is to invest a portion of my savings every month. An important note here is that the numbers you will see in this report reflect the gains and losses of my invested capital only. When I invest more, for example, I would not state this as a gain in the value of my portfolio.

Similarly, if I sell a portion of my investments, this would not be stated as a loss in the value of my portfolio. The numbers simply reflect the performance of the underlying investments. Simply put, a loss/gain does not take into account buying/selling assets.

Vanguard Stocks and Shares ISA

All investments are held in a stocks and shares ISA with Vanguard. You can contribute anything up to the limit of £20,000 for the 2018/19 tax year. This means, when it comes to selling any portion of my investments, any capital gain is tax free.

September Returns (-0.22%)

Illustrated below you can see each fund I own, the target weight of that fund in my portfolio overall, the actual weight and the monthly return. Buying into an index fund is effectively the same as buying into an already well-diversified portfolio. For example, the ‘Emerging Markets Stock Index Fund’ consists of over 1,099 individual stocks. These funds each represent a market of their own.

These are rounded figures so sometimes they will not add up to 100% exactly.

The complete monthly return for September was -0.22%. All funds were down from last month. The global fund was down 0.23%; The US fund was down 0.04%; The UK fund was down 0.19%; and the Emerging Markets fund was down 1.46%.

As I stated in last month’s report, I invest around the 22nd of the month and I rebalance with new cashflow. As a result, my fund weightings are very close to target.

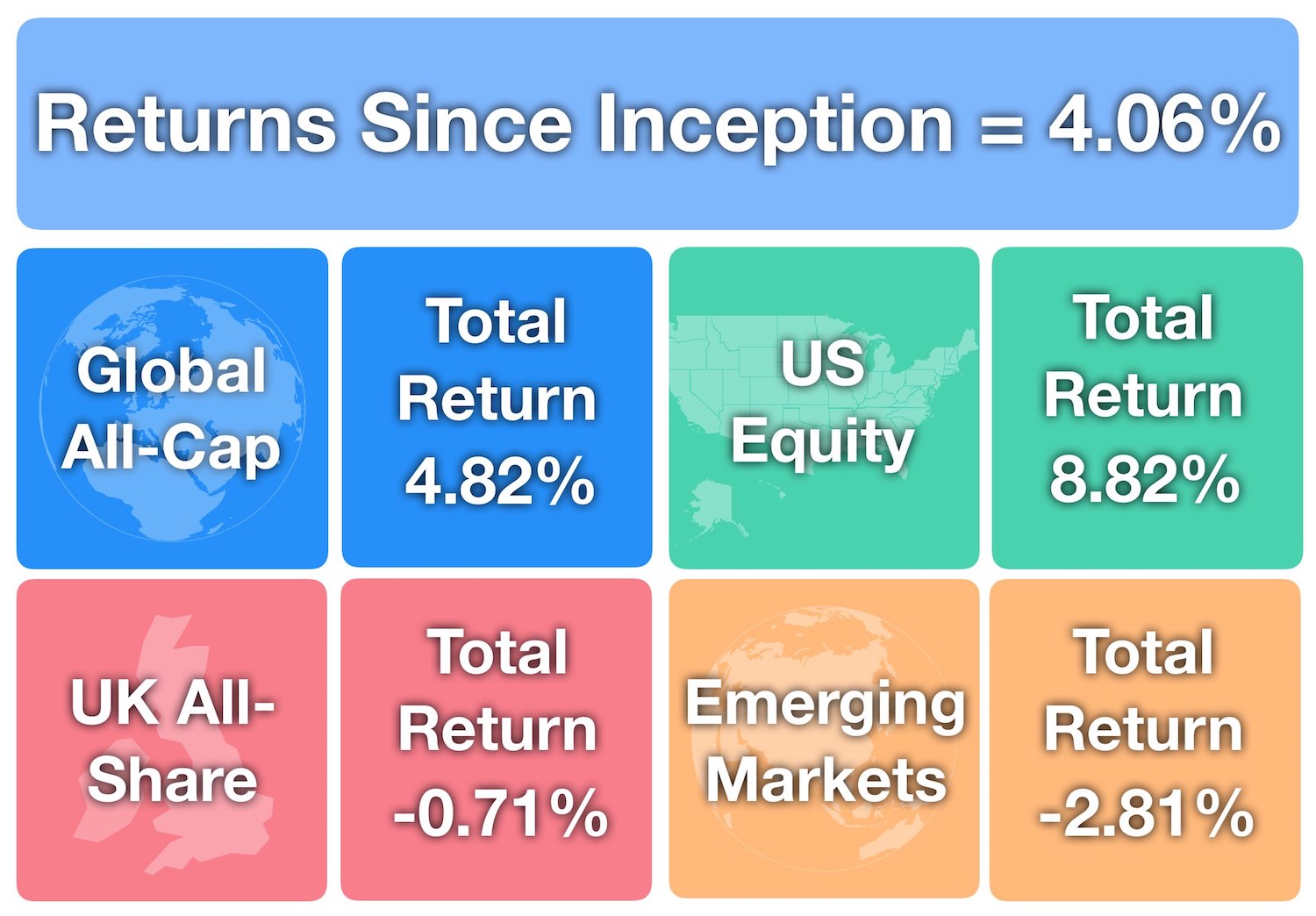

Returns Since Inception (+4.06%)

Below are my returns since inception. Inception being the end of May 2018. The total portfolio return is +4.06%. The Global (+4.82%) and US (+8.82%) funds are positive and the UK (-0.71%) and Emerging (-2.81%) funds are negative. This is diversification doing its job.

Sector Breakdown

You can see the sector breakdown of my entire portfolio below. Note these numbers are rounded so might not always total 100% exactly. This month, most sectors saw some movement.

Financials decreased from 21.2% to 20.3% of my portfolio. Industrials increased from 11.4% to 11.5%. Health Care increased from 10.4% to 11.3%. IT increased from 9.6% to 10.2%. Consumer goods fell from 7.7% to 7.6%. Consumer services grew from 6.7% to 7%. Technology grew from 4.3% to 4.7% and the percentage of other sectors in my portfolio fell from 17.8% to 16.4%.

Sector definitions can be confusing. Take 'IT' vs ‘Technology’. Effectively, the difference is in what each is valued for. IT is valued for the delivery of information (eg. a phone/computer). Technology is broader and can be valued for the delivery of transportation or energy etc.

The other major confusion is between 'Consumer Goods', 'Consumer Services' and 'Consumer Discretionary'.

Consumer goods are products bought by the average consumer. These products are the end result of a production or manufacturing process. Food would be an example of a consumer good.

A consumer service (a.k.a customer service) is a process which ensures consumer satisfaction. An example of this would be a phone or e-mail interaction.

The consumer discretionary sector is comprised of desirable but non-essential goods. Luxury items, entertainment and leisure would be included in this. The financial sector is, globally speaking, a dominant market sector. This is reflected in the sector breakdown above. ‘Other Sectors’ can include utilities, materials, and real estate.

Top Sectors In Each Fund

Not including ‘other sectors’, here is a more detailed breakdown of the top 3 sectors in each fund. Note the dominance of the IT sector in the US and the Financial sector in the UK.

Global: Financials (21.62%), followed by technology (14.9%). Technology has replaced industrials (13.9%), which is now the 3rd largest sector in this fund.

US: IT still dominates the top spot (25.29%), followed by Health Care (14.3%), which has replaced Financials (now at 14.19%).

UK: Financials (25.49%) is still the largest sector, followed by Consumer Goods (14.11%) and Oil & Gas (13.81%). No change in the top 3 from last month.

Emerging: IT (27.51%), followed by Financials (23.09%) and Consumer Discretionary (9.24%). No change in the top 3 from last month.

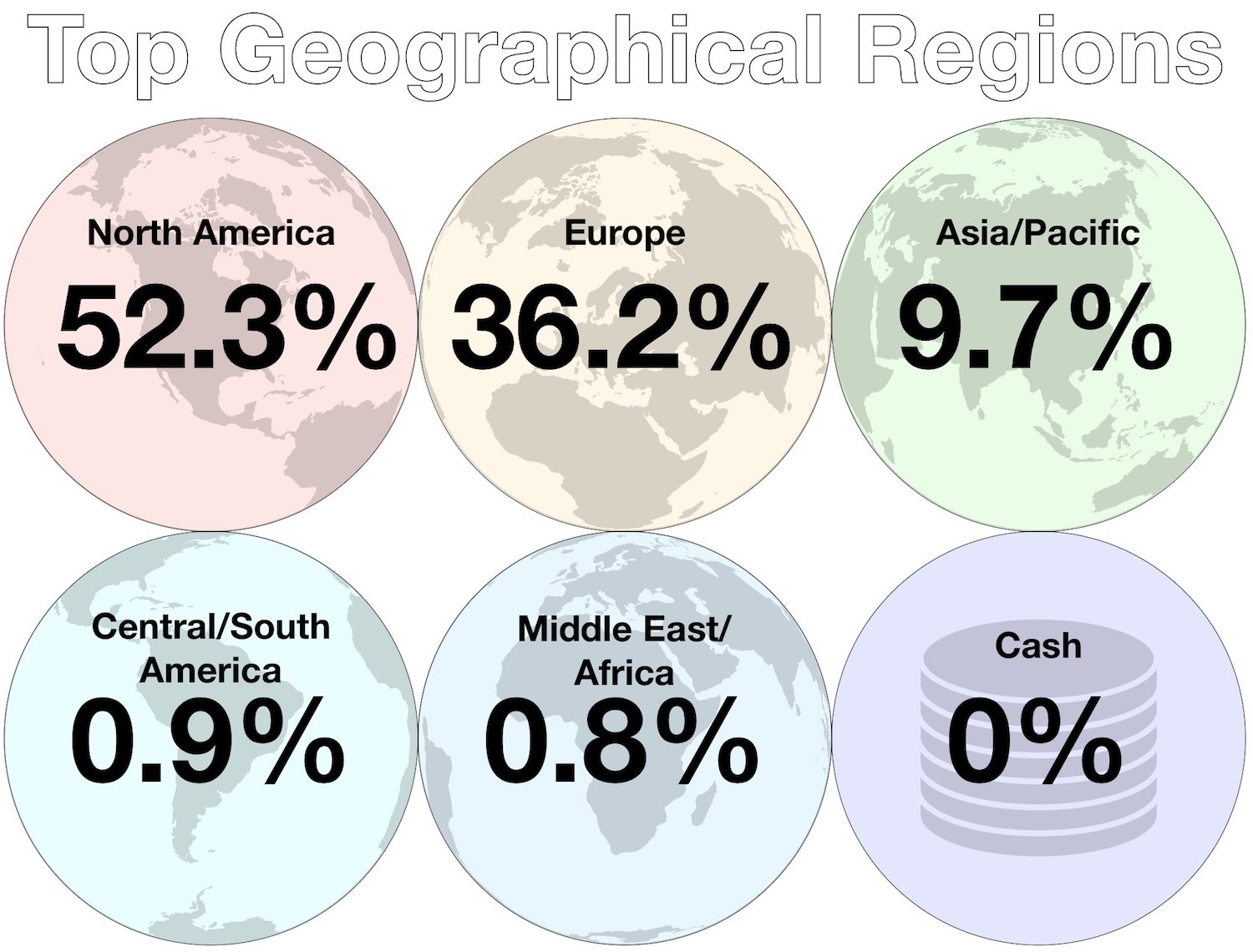

Geography

North America continues to geographically dominate my portfolio, accounting for 52.3% (up from 51.1% last month). Europe (including the UK and Eastern Europe) has decreased slightly as a percentage of my portfolio from 36.3% to 36.2%. Asia pacific is down from 10% to 9.7%. Central/South America is down from 1.1% to 0.9%. And Middle East/Africa is down from 0.9% to 0.8%.

Cash is down from 0.7% to 0% of my portfolio.

Whilst not displayed here, it is worth pointing out that some regions make up a substantial portion of the world market despite a small geographical size. Japan (8% of the Global fund) and the UK (5.5% of the Global fund) are good examples of this.

My portfolio is weighted towards the developed world but developing countries are still represented. This is done primarily through the Emerging Markets fund (5% target weighting). The Asia-Pacific region is well-represented here (75.3%, up from 72.46% last month).

This large share is influenced to a great extent by the size of the Chinese market. Central America, South America, The Middle East and Africa only make up a small percentage of each fund and therefore my entire portfolio (1.7%, down from 2% last month).

Individual Investments

This section looks at the biggest individual investments in my portfolio overall. There has been a lot of movement this month.

Apple (1.9% up from 1.5%) has replaced HSBC (1.7% down from 1.8%) in the number 2 spot. Amazon (1.4% up from 1.2%) has also switched places with BP (1.3%, no change from last month). Alphabet, Google’s parent company (1.3% up from 1.1%) has switched places with B.A. Tobacco (1.1%, no change from last month).

Diageo, new to the top 10 list last month has been replaced with another newcomer to the top 10 list, Astra Zeneca. This large Anglo-Swedish pharmaceutical company was founded in 1999 and is headquartered in the UK.

My largest investment remains the London Stock Exchange traded Royal Dutch Shell (2.6% down from 2.8% last month)

As predicted, Amazon was the next company to achieve $1 trillion status. However, this was only achieved briefly. On Tuesday the 4th of September, Amazon’s stock price hit a high of $2050.50. A price of $2050.27 was required to hit a $1 trillion valuation. By the closing bell, however, Amazon’s stock price had fallen to $2039.51. As it stands (30/9/18), the stock is priced at $2003 per share, putting the company’s valuation at $976.95 billion.

Dividends

The Vanguard Index Funds I own are all accumulating. This means any dividend income is automatically reinvested so I don’t have to process that myself. I am huge advocate of dividend reinvestment for long term wealth-building.

Goals For October

I am in the process of drip-feeding an equally divided lump sum into the market over the next year. October will be month 6. I decided to drip-feed my lump sum as insurance against a market decline. I will only benefit from this 'insurance', over investing all at once, if the market declines during the next 6 months. This report marks the first decline month-to-month since I started the reports in June. However, since that date, my returns remain positive at 4.06%.

Investing consistently is important to me. Any decline (bear market) is difficult to predict but continuing to invest during a fall can actually increase returns over the long term when prices rebound. Drip-feeding insures against a falling market, the system of continuous, regular investing insures against emotion-based decision making.

I am rebalancing my portfolio as I invest to maintain it’s current risk profile. Portfolio drift, where the weightings (ie. 30% in fund A) can shift from target as time goes on, can occur if this is ignored. I will need to use a different strategy once the drip-feed process is complete next year. In all likelihood I will continue to use new capital to invest and rebalance at the same time. But until then, I use a portion of my lump sum and new capital to rebalance.

That concludes the September 2018 update. If you liked this post, hit the like button down below. Also, in the comment section down below, let me know if there’s anything you want me to include in next month’s report. I’d love to hear about your investing experiences as well. I read and reply to every comment.

Recommended Resources

If you’re looking for resources to better your own personal finances, here are some of my recommendations:

Get 1 Free Share With FreeTrade - Sign up for free to the FreeTrade investing app and get 1 free share (up to £200 value) with my referral bonus.

Savings/Investment Spreadsheet Downloadable - 10% of profits go to a charitable cause.

Facebook - UK Passive Investing Group - Join A Like-Minded Community

Check out my offers page to earn some free money and grab some freebies.

Rich Dad, Poor Dad by Robert Kiyosaki

The Little Book of Common Sense Investing by John C Bogle

The Intelligent Investor by Benjamin Graham

References

Vanguard FTSE Global All-Cap Index Fund (Accumulation)

Vanguard US Equity Index Fund (Accumulation)

Vanguard FTSE UK All-Share Index Unit Trust (Accumulation)

The best UK free share referral offers, updated throughout April 2024. Get free stocks and shares with Shares App, FreeTrade, Stake and more.